SaaS Revenue Recognition: Scenarios, Standards, and Methods

Proper revenue recognition is vital for SaaS businesses, but a common challenge for most businesses. Read on to find everything you need to know about it.

Jump to read

What is Revenue Recognition?

Revenue Recognition Scenarios

Revenue Recognition Standards

How Did SaaS Revenue Recognition Change with ASC 606 and IFRS 15

Challenges Associated with SaaS Revenue Recognition

Types of Revenue Recognition Methods

How to Recognize Revenue Under IFRS 15 and ASC 606

Trends and Technologies That Will Affect the Future of SaaS Revenue Recognition

How to Streamline SaaS Revenue Recognition with Subscription Management Solutions

FAQ

Final thoughts

Revenue recognition plays an important role in business accounting. It’s one of the generally accepted accounting principles (GAAP) that deal with how and when a business should recognize revenue.

And it only gets complicated with custom and mixed pricing plans for B2B SaaS. This makes recognizing revenue a challenging process.

So, how do you get it right for your SaaS business?

That’s where revenue recognition scenarios and rules like IFRS 15 and ASC 606 come into play. They give you a framework to work with.

Let’s understand all about it in detail.

What is Revenue Recognition?

It refers to the process through which a business determines the revenue it has generated through the sale of products or services.

In cash-based accounting, revenue recognition is simple. You recognize revenue when you get the cash or money in your account. It’s the traditional way of conducting business and recognizing revenue.

However, with the advent of SaaS businesses and subscription business models, revenue recognition has become a lot more complex.

How do you recognize revenue for a service you’ve not provided yet but the customer has already paid for? You’d think that the moment you receive the payment, revenue recognition is done, right?

What if the customer cancels their subscription or downgrades/upgrades their plan?

With different types of SaaS businesses working with different pricing models and payment terms, revenue recognition is more complex than ever before.

In accrual-based accounting followed by SaaS companies, revenue can be recognized when two conditions are met:

- A critical event has occurred. For example, you’ve delivered the subscription service that was promised.

- You can accurately measure the amount of money received for the said service.

So, even if you receive advance payment, you can only recognize revenue after delivering the service.

Before we delve deeper into subscription revenue recognition accounting principles and processes, let’s cover some basics, such as the various scenarios for revenue recognition.

Also Read:

- Revenue Growth Management: What Is It and Why It’s Important

- 6 ways to sustain & grow revenues during renewals

Revenue Recognition Scenarios

First things first—let’s figure out the various scenarios of revenue recognition. This refers to the timing when you can potentially recognize revenue for your business.

Note that not all of these apply to a SaaS business, but we want to discuss them to set some context for revenue recognition.

Here are the three possible scenarios.

1. Immediately on Receiving Payment

In this method, the revenue is recognized as soon as you receive the payment. It’s typically best suited for one-time purchases like selling a software solution.

Let’s say you sell a lifetime license for your product for a flat one-time fee of $120. In this case, the revenue of $120 is recognized as soon as you receive the payment, irrespective of whether a customer uses the software solution or not.

2. After Payment is Received

This method is most commonly used in SaaS and it recognizes the revenue after a service is delivered. For instance, if you’ve sold an annual subscription for $120 you’ll divide the amount by 12 and recognize $10 every month.

Even if you’ve received the entire payment in advance, you will recognize $10 at the end of every month, as you deliver the promised service.

3. Before Payment is Received

You can also recognize the revenue before you receive the payment. It’s one of the key concepts of accrual accounting where you recognize the revenue when you perform the service or sell the product, even though you may receive the payment for it later.

In many B2B scenarios, businesses have long-term contracts with clients and different payment terms. In such cases, you can recognize the revenue for the delivered service, even if payment is pending from the client’s side.

Now that we’ve covered that, let’s discuss the common revenue recognition and accounting principles and standards that SaaS businesses must follow.

Also Read:

- How B2B SaaS Finance Teams Can Use Technology to Their Advantage

- How to Cut Tedious Tasks and Seize a Strategic Finance Seat

Revenue Recognition Standards

Now that you know about how revenue is recognized, let’s understand the two main standards dealing with revenue recognition.

IFRS (International Financial Reporting Standards) 15

It’s an international accounting standard that outlines how companies record revenue. IFRS 15 came into effect from 1st January 2018 and impacts how businesses report their revenues in financial statements.

Businesses operating in countries that use IFRS have to follow this standard to remain compliant.

ASC (Accounting Standards Codification) 606

ASC 606 is an accounting standard that governs how businesses can recognize revenue in different scenarios. The full form of the term is Accounting Standards Codification 606.

Like IFRS 15, ASC 606 deals with revenue recognition for companies in the United States. It was issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). It came into effect for public companies from 15th December 2017 and private ones from 15th December 2018. SaaS companies need to follow ASC 606 standards to remain compliant.

Additionally, US businesses that operate internationally would be required to use both ASC 606 and IFRS 15 to remain compliant in multiple jurisdictions.

Also Read:

- How to reduce churn (with subscription billing & AI-powered customer success)

- Three Ways To Help Make Your Subscription Sales Recession-Resistant

How Did SaaS Revenue Recognition Change with ASC 606 and IFRS 15

Both these standards created well-defined rules for how and when companies can recognize revenue from customer sales. While this was straightforward for traditional businesses, those with subscription business models were affected by this the most.

The simple reason is that subscription businesses have more varied and complex payment scenarios than regular businesses. People don’t pay to buy goods or services one time but to keep using them for a period of time.

They can make one-time payments in advance or after the service is delivered or pay recurring fees on a monthly, quarterly, or annual basis.

Before these standards came into effect, there was ambiguity about when SaaS companies should recognize revenue.

Now, however, there’s a lot more clarity and well-defined rules that make revenue recognition more straightforward, if not easy.

These standards provided a robust framework to streamline financial processes and reporting.

Also Read:

- Prioritize Cashflow Management (Above all Else) for B2B SaaS Success

- Managing Cash Flow in Challenging Times

Challenges Associated with SaaS Revenue Recognition

If you want to streamline the revenue recognition practices for your SaaS business, you need to understand all the complexities associated with it.

We’ve briefly touched upon this earlier, but let’s delve a bit deeper into the various SaaS revenue recognition scenarios and the associated challenges in this section.

Let’s get started.

1. The Problem of Deferred or Unearned Revenue

The most basic problem that subscription businesses face with revenue recognition is that they often deliver services after a customer has paid.

Let’s say, someone bought a monthly subscription for your SaaS product and made an upfront payment. You have received the money but the services will be delivered for a month before you actually earn that revenue.

Till then, the revenue is deferred revenue or unearned revenue, which can’t be recognized. After all, a lot can happen during that period. The customer can change their plan or cancel the subscription, which could lead to price changes or refunds.

According to ASC 606, you can’t recognize revenue till the service is delivered. This makes revenue recognition difficult for long-term contracts where service is delivered for years before the contract is fulfilled.

Solution:

In such cases, you can use a systematic approach where you recognize the portion of the revenue you have actually earned at the end of each month. Using a SaaS billing software solution like Younium can help automate that process.

Younium will automatically calculate the revenue from each client every month and even generate accurate invoices and send payment reminders. This ensures that you not only recognize revenue correctly but also receive payments on time.

2. Revenue Recognition for Custom B2B Contracts

This revenue recognition challenge is specifically for B2B SaaS businesses that work on custom contracts, rather than fixed subscription plans. Most SaaS businesses offer custom pricing and contracts for their enterprise clients.

For context, here’s an image showing the various types of contracts or bookings for SaaS businesses.

Apart from that, each contract is negotiated separately and is unique. As such, all clients may have different services (distinct performance obligations), prices, and payment schedules.

This requires extensively detailed calculations and recordkeeping to ensure you have an accurate revenue recognition process for each client. As you can imagine, this is practically impossible to do manually, especially if you deal with hundreds or thousands of clients.

Solution:

Here, the use of a subscription management platform like Younium becomes mandatory, not optional. It can streamline the entire revenue recognition process and calculate earned revenue from each client every month, without error.

3. Upgrades, Downgrades, or Plan Changes

Another common revenue recognition challenge for SaaS businesses is that subscriptions are not fixed and can be changed by customers at any point.

The exact rules for how plan changes are implemented may differ from company to company, but most SaaS companies allow some flexibility in their subscription plans and contracts.

This means that customers can opt for a higher-tier or lower-tier plan at any time, which will change their subscription fees. Your entire revenue recognition workflow can be disrupted at the click of a button because of these unpredictable plan changes.

Solution:

The best way to handle these variables is to use a good B2B subscription management platform like Younium. It will automatically adjust the price changes, generate accurate invoices, and recognize the correct revenue for each period.

This is more advanced than revenue recognition via spreadsheets, where the chances of error are astronomical. Here are some benefits of using a platform like Younium, which offers integrated revenue recognition, over spreadsheets.

Image via Younium

4. Revenue Recognition for Bundled Services

If you run a subscription business, you know how profitable selling bundled products and services can be.

Bundles help you combine bestselling plans and services with less popular ones by offering a discount on the combined price. Alternatively, they can be used to simply increase the subscription prices per customer and boost your annual revenue.

So what’s the challenge with selling bundles?

Well, the challenge arises in identifying distinct performance obligations and revenue for individual services within a bundled package.

If you charge additional fees for training and initial setup, for example, the revenue recognition will be different from that of your core service. The training might be completed in one month while the client will keep using the software solution long after that. The setup could be done in a day or two.

Since each service is delivered within a different timeframe, you can’t recognize revenue for all at the same time.

Solution:

In this case, you’ll need to break down the total fee into smaller parts for each specific service. You’ll recognize the revenue for each service after it’s delivered.

5. Subscription Cancellations and Refunds

One of the most common revenue recognition challenges for SaaS businesses is the inability to recognize revenue because customers can cancel their subscriptions at any time.

Let’s say a customer bought a six-month subscription and paid for it in advance. Since you’ve received the money, you’d think you can recognize the revenue. However, as mentioned earlier, this is deferred revenue and can’t be recognized.

Now, you can follow the monthly revenue recognition method of recognizing revenue after each month.

The problem arises when a customer cancels their subscription somewhere in the middle of a month and you need to calculate the earned revenue and refund the rest.

Solution:

Doing such calculations of hundreds of clients manually is not feasible. That’s where software solutions like Younium come into play. These can automatically calculate earned revenue and refund amounts and optimize your financial workflow and revenue recognition.

6. Revenue Recognition for Additional Services

Many SaaS businesses offer add-on services, which are charged over and above the fixed subscription plans. These could be consulting services or more personalized, high-touch assistance for customers to better use a company’s software solution.

Also, a customer could be on a fixed monthly plan, but may choose to opt for some add-on services one month and not in the others. This will change the customer’s monthly fees and there’s no way to predict which add-on services a customer would opt for in any given month.

These variable costs add more complexity for revenue recognition, as you have to account for these fees that vary from month to month.

Solution:

There is no way around this, except to recognize the exact revenue earned each month, including the monthly portion of the subscription cost and the fees for the add-on services utilized in a particular month.

7. Inability to Meet FASB Criteria

Transferring ownership or control of a product or service is one of the criteria for revenue recognition under ASC 606. This is difficult for SaaS companies because technically the ownership is never transferred.

Customers don’t buy the product or service but pay to use it for a specified time.

Similarly, the standard uses performance obligations as a key parameter for revenue recognition. Defining these performance obligations is more difficult for SaaS businesses as it’s not as simple as selling a product or delivering a one-time service.

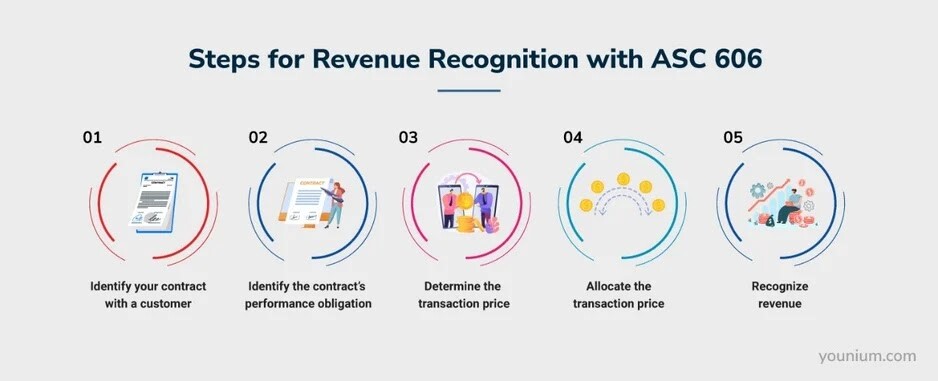

Following the five-step ASC 606 revenue recognition model itself is a challenge for SaaS companies as they don’t clearly fit the different criteria.

Solution:

Though it’s more difficult to fit the criteria, it’s not impossible. SaaS companies need to clearly define performance obligations based on customer contracts to ensure proper revenue recognition.

Although ownership is not transferred, you can consider the revenue earned once a customer has used your software solution for a period. For example, if a customer has used your product for a month and hasn’t canceled their subscription, you have earned that month’s revenue and that revenue can be recognized.

However, you can’t recognize revenue in advance, you have to wait till the services have been officially delivered.

Also Read:

- SaaS revenue data insights and efficiency metrics

- Key SaaS metrics you need to grow your business in 2024

Types of Revenue Recognition Methods

Before we explain the process of revenue recognition for SaaS under ASC 606 and IFRS 15, let’s first understand the various methods of revenue recognition.

Some of these are relevant to SaaS businesses, while others are not. However, understanding these will give a better understanding of why certain methods work best for SaaS businesses.

Let’s get right to it.

1. Completed Contract

This is one of the simpler revenue recognition methods where you count revenue as earned only after your customer contract is fulfilled.

As such, if your contract takes months or years to complete, you will have to wait till then to recognize revenue, irrespective of when you receive the payments.

This is useful in certain types of professions like construction projects where a contractor is obligated to complete construction before they earn the revenue. This is not very common in SaaS businesses because this will discourage long-term contracts instead of encouraging them.

However, this comes in handy when you can’t clearly define performance obligations to use the percentage of completion or proportional performance methods. It’s also suitable for revenue recognition for short-term projects.

2. Percentage of Completion

In this method, you recognize revenue periodically as a specific percentage of the contract gets fulfilled.

Let’s say you have a multi-year client contract, which you plan to complete in stages. After each stage is completed, you can recognize the portion of revenue for that stage.

However, note that time is not the criteria for determining the percentage of completion, but it depends on meeting your performance obligations. As such, for SaaS companies, the proportional performance method is better suited.

This method is great for businesses that fulfill client contracts in stages. For simple subscription businesses that count time as the key parameter for measuring contract completion, this method will simply add complexity.

3. Proportional Performance

This is another revenue recognition method that allows you to recognize revenue over time for long-term subscriptions.

For example, let’s say a client has a one-year subscription and has paid you $1000 for it. After the first three months, 25% of the contractual obligations would be fulfilled, so you can recognize $250 as revenue. After 6 months 50% will be done, 75% at 9 months, and 100% at 12 months.

You can recognize revenue at the end of each quarter.

Of course, it doesn’t always have to be a quarter and you can recognize revenue monthly if you prefer that. Alternatively, for long-term contracts, you can choose to recognize revenue annually.

It works very similarly to the percentage of completion method in that revenue is recognized as a specific portion of services are delivered.

However, this is better suited for SaaS businesses because the criteria for measuring the proportion is time. If a client has used your SaaS product for six months out of a year, you have earned 50% of the total revenue.

The percentage of completion method, on the other hand, is better suited for construction companies or businesses where projects are completed in stages.

Here are two reasons why you should choose this method:

- First, it allows you to recognize revenue quickly, instead of waiting for a contract to complete. This ensures you have more money in hand to run your business and avoid any cash flow challenges.

- Second, it allows you to keep track of how much of your performance obligations you’ve completed at any given time. This gives clarity on how much time is left till you need to convince a client to renew their subscription.

4. Installment

This is also a traditional revenue recognition method that is still relevant in today’s business scenario.

Here, a customer would make installment payments for a long-term contract, typically after a specified duration and partial delivery of services.

Let’s say, a customer has taken a one-year subscription and opted for paying for it in monthly installments. The monthly payment would be one-twelfth of the total subscription cost and would be paid at the end of each month.

In this case, you can recognize the revenue after you receive each installment.

Since different clients may have started their subscriptions on different days, you may receive monthly payments from them on different dates in a month.

This is a great revenue recognition method for SaaS businesses because:

- It gives enough flexibility to account for subscription cancellations as you only recognize revenue that you’ve already earned.

- This prevents you from recognizing the yearly revenue all at once, which could be affected by plan changes and cancellations later.

5. Point-in-Time

Under this revenue recognition method, you look at the point in time when you transferred ownership of the product or service to mark your revenue as earned.

The problem with this is that SaaS companies never transfer ownership of the product, only let customers use it. They count it as a service provided.

Since the way subscription business models work doesn’t fall within the traditionally defined criteria of ownership transfer, this method of revenue recognition doesn’t work for SaaS companies.

6. Sales-Basis

This is the revenue recognition method used by B2C companies that sell products rather than services. As soon as a customer makes a purchase, the company can recognize the revenue made from that sale.

This is a very simplistic way of revenue recognition, which doesn’t apply to SaaS businesses as no goods are being sold and there are tons of other complexities.

7. Cost Recovery

This is a traditional method of revenue recognition, which is rarely used by SaaS businesses. Still, it may be useful in cases where there’s a lot of uncertainty involved and other revenue recognition methods can’t be used accurately.

So how does it work?

It involves recognizing profits after a company has recovered all costs it incurred on a project. As such, first a company will pay itself back for all the costs it incurred and then it will start recognizing the excess as profit.

But how do you calculate the costs for a SaaS business, given that there are no actual physical products?

Here are some costs you can consider for your SaaS business.

Given that this is not suitable for SaaS businesses, we don’t recommend you consider using this method.

Now that you have a grasp of the common revenue recognition methods and which ones are great for SaaS companies, let’s discuss how you should recognize revenue under ASC 606.

Also Read:

- Mastering Net Recurring Revenue: Key Insights for 2024

- How to fix revenue leakage in a recurring revenue business

How to Recognize Revenue Under IFRS 15 and ASC 606

While ASC 606 and IFRS 15 have some minute differences, the process of recognizing revenue is very similar.

Here are the steps involved.

1. Identify the Contract with a Customer

To start, there are a few criteria that should be met when your SaaS enters into a contract with a client.

- Both parties have approved the contract in any mode (writing, verbally, or otherwise) and are committed to abide by its terms.

- Rights of both the parties are identified and recognized by each.

- The SaaS business and client have identified and agreed to the payment terms.

- Contract must have commercial substance.

- Your SaaS will collect payment from the client for the services it offers.

2. Identify Performance Obligations

Next, you have to identify your performance obligations. These are essentially the promises your SaaS makes to transfer services to the client for the given time period.

You have to specify each performance obligation that can be transferred individually to the client. A performance obligation can be:

- Single service or its bundle that’s distinctly identifiable

- A series of services that are similar and have the same pattern for transfer

Additionally, your performance obligation should satisfy the below criteria:

- The client should be able to benefit from your services on their own or in combination with other resources they have available.

- Your promise to transfer the service to the client is distinctly identifiable from the other promises in the contract.

3. Determine the Transaction Price (TP)

This stage involves setting a price for the transaction between your SaaS and the client. The transaction price here would be the cash and non-cash compensation that your SaaS will receive for providing the services to your client.

While setting the transaction price, you should also account for any discounts, pricing customizations, and other adjustments.

Here are some other things you can consider when determining your transaction price.

An important thing to note here is that the transaction price isn’t always the price set in the contract. Instead, it’s the expectation of what you’ll receive. If it’s variable, you’d have to estimate it by either using the expected value or the most likely amount.

4. Allocate Transaction Price to Performance Obligations

In this step, you have to allocate the transaction price your entity expects for each performance obligation. This is particularly important for SaaS businesses as the performance obligations are spaced out over a time period.

In such a case, your transaction price has to be deferred and allocated correctly. This could, however, be challenging and that’s why you should consider using a platform like Younium.

And if you have multiple performance obligations, the key is to find your standalone selling price (SSP). For that, you can use one of the following methods:

- Adjusted Market Assessment Approach

- Expected Cost Plus Margin Approach

- Residual Approach

Let’s consider a scenario where your total customer contract value is $62, 500, but you offer a discounted price of $50,000 to a customer. Unless the discount applies to a specific service, you’ll need to set the transaction price price for each service by applying the discount proportionally.

Here’s the breakdown, for this example.

5. Recognize Revenue On Satisfying Each Performance Obligation

The last step in revenue recognition through IFRS 15 and ASC 606 is to recognize your revenue as you satisfy each performance obligation.

For a SaaS business, you would have to do this over time as the performance obligation will be satisfied during the entire course of the subscription.

So, if you’ve signed up a client for an annual subscription, you would have to attribute each month’s payment to the respective monthly accounting period. You must not recognize the entire lump sum when it’s received.

Also Read:

- How to Create a Subscription Revenue Model Template in 2024

- Forecasting Subscription Revenue: How to Do It Right

Trends and Technologies That Will Affect the Future of SaaS Revenue Recognition

By now you should clearly understand how revenue recognition for SaaS companies works under ASC 606 and IFRS 15.

Now, let’s discuss some recent SaaS trends and technologies in finance that have the potential to change SaaS revenue recognition in the future.

Here you go.

AI and Automation

Artificial Intelligence is the most influential of all current technologies that will affect SaaS revenue recognition.

AI can accurately track revenue for varied SaaS scenarios and use the right revenue recognition methods to identify earned revenue and deferred revenue for different clients. The best part is that it can do this at scale, without much human input.

This can automate the revenue recognition process for SaaS companies, taking the headache out of it.

While there are some really good software solutions that are already automating SaaS revenue recognition, AI will continue to evolve and make these solutions even better.

AI and Predictive Analytics

Machine learning can help AI systems to learn from past data to predict future trends. This can help SaaS companies predict churn and account for future subscription cancellations in their revenue recognition process.

Moreover, AI can improve the depth and accuracy of SaaS analytics by tracking financial SaaS metrics in real-time. The more accurate your financial analytics and reporting, the better your revenue recognition process will be.

Blockchain Technology

This technology introduced a new and unique way of managing contracts and financial transactions, with implications and use cases across industries.

SaaS businesses can use this technology to create smart contracts with customers that can automate financial transactions when specific conditions are met. This allows for better record-keeping of financial transactions, as each transaction is automatically recorded, without any human involvement.

This will come in handy for financial audits as you’ll have perfect records of all financial transactions.

Regulatory Tech

With financial regulations becoming more complex over time, new technology solutions are coming up to help SaaS companies stay compliant and manage their finances well.

These regulatory technology (RegTech) solutions help SaaS companies navigate the regulatory landscape with ease.

Here are some use cases of RegTech in SaaS:

- Platforms like Younium automatically calculate taxes for transactions in different regions, ensuring tax compliance with local laws. You don’t need to manually add taxes and deal with complex tax calculations when a tool can do it for you.

- There are risk assessment tools that can help you identify the significant risks associated with the use of your customer data. These ensure you don’t violate any privacy laws or put customer data at security risk.

There are many potential use cases of RegTech in SaaS companies, which can affect the revenue recognition process in the future.

Evolving Standards

Lastly, technology is also useful in keeping up with the evolving revenue recognition standards. ASC 606 was just the most recent update and the standards will continue to evolve as there is a need for better revenue recognition for SaaS companies.

As SaaS companies don’t fit all the existing criteria and definitions, standards may evolve to include SaaS business models more comprehensively.

As standards evolve, so will tools and technology that help SaaS companies comply with those standards.

Also Read:

- Beat funding blues in economy decline: Guide for B2B SaaS

- Bracing your SaaS Business in an Economic Downturn

How to Streamline SaaS Revenue Recognition with Subscription Management Solutions

B2B subscription management solutions like Younium offer tons of useful tools and features that help with accurate revenue recognition for SaaS companies.

Younium allows you to create revenue recognition rules for different clients that automate the process.

Here are some of the numerous options that you can choose from:

- Recognize revenue on a monthly basis, based on proration

- Recognize revenue monthly over time but on a frontload or backload method

- Use the upfront revenue recognition method

- Use a manual setting for distributing revenue over time

- Use a mix of these and other revenue recognition methods

Check out this video to understand the various ways in which Younium can help SaaS companies with revenue recognition.

Image via Younium

To give you more clarity, let’s discuss the various distribution methods to distribute revenue over time:

- Prorated: If a customer started in the middle of a month, the revenue for that month will be calculated based on the number of days the subscription was active. For all complete months, revenue will be calculated as usual by dividing the total subscription cost by the number of months.

- Frontload: In this case, even if the subscription started in the middle and not the first day of a month, the first partial month will get full revenue recognition.

- Backload: In contrast to the frontload method, here the last partial month of a subscription will get the full revenue recognition.

- Days: The revenue is recognized by the number of days in a month, such as 31 for January, 28 for February, and so on.

Let’s understand this with the help of an example.

Consider the following scenario:

- Subscription cost: 1,000 Euro per month

- Subscription starts at: 2024-01-15

- Subscription ends at: 2024-03-14

In this case, both January and March are partial months. Here’s how revenue will be calculated based on the prorated, frontload, and backload methods.

Image via Younium

Apart from these, Younium also allows you to use a mix of upfront and spread-over-time distribution methods. You can, for instance, choose to recognize the first invoice upfront and distribute the rest over time. Or you may choose to recognize a percentage of revenue upfront and the rest can be distributed over time.

This is great for companies that offer onboarding support or extra services at the start of a subscription. You can recognize those fees upfront while the subscription costs can be distributed over time.

With so many rules and configurations, Younium supports all types of SaaS businesses with varied subscription pricing models.

Also Read:

- 7 benefits of a subscription management solution

- 9 Most Important Subscription Management Software Features

FAQs

Q1. What is the ASC 606 revenue recognition rule?ASC 606 is a revenue recognition standard that includes a set of rules and guidelines businesses in the United States have to follow to report their revenues.

Q2. What are the 5 steps of revenue recognition under ASC 606?The 5 steps of revenue recognition under ASC 606 are:

- Identify contract with customer

- Identify performance obligations

- Determine transaction price

- Allocate transaction price to performance obligations

- Recognize revenue on satisfying each performance obligation

IFRS 15 is the section that deals with revenue recognition. The guidelines state that the business will recognize revenue based on the transfer of the performance obligation to the client and should reflect that.

Q4. Does ASC 606 apply to IFRS?No, ASC 606 is a standard that’s specific to the United States, while IFRS 15 applies to companies in countries that use the IFRS accounting standards.

Q5. How does ASC 606 affect revenue?ASC 606 affects how you report your revenue in financial statements as you have to follow the accrual revenue recognition principle.

Final Thoughts

In the complex world of revenue recognition for B2B SaaS companies, having a reliable subscription management solution like Younium is invaluable. These solutions offer a seamless way to track and manage subscriptions, ensuring compliance with revenue recognition standards such as IFRS 15 and ASC 606. They assist in automating the allocation of revenue to performance obligations and streamline the entire process.

Younium, for example, simplifies revenue recognition and ensures that your SaaS business remains compliant with these critical accounting standards. By leveraging Younium B2B SaaS companies can confidently navigate the complexities of revenue recognition, forecasting revenue and focusing on their core business while adhering to the latest accounting regulations. Younium's subscription management capabilities make it easier than ever for businesses to manage revenue recognition efficiently.

That wraps up our step-by-step guide to revenue recognition for IFRS 15 and ASC 606. Follow these steps to ensure your SaaS remains compliant with these standards.

Finally, make sure you use the right software solutions that help you simplify revenue recognition.

Discover how Younium's integrated built-in revenue recognition solution can help you streamline your B2B SaaS business's revenue recognition effortlessly. Get a demo of Younium to see how it can elevate your subscription management.