How B2B SaaS Finance Teams Can Use Technology to Their Advantage

Implementing technology in finance has transformed the way B2B SaaS companies operate today. Read on to learn the applications and benefits technology offers.

Jump to read

What is technology in Finance?

Benefits of using technology in finance

Applications of Technology in Finance for B2B SaaS Companies

Wrapping Up

FAQs

In today’s digital age, companies that leverage technology in their day-to-day processes are always one step ahead. Without a doubt, technology has revolutionized the way B2B SaaS companies conduct business, particularly in the finance departments.

Integrating technology into your financial operations is gradually becoming a necessity. Not only does it optimize financial workflow, but also reduces man-hours and enhances the quality of customer relationships.

Are you still on the fence, stuck between embracing technology in finance or sticking to traditional methods? If you are, this guide will teach you why you should embrace technology in 2025.

We will discuss all the benefits and applications of technology in finance and how you can leverage it to transform B2B SaaS business operations.

Here we go.

What is Technology in Finance?

Simply put, technology in finance refers to the strategic integration of advanced tools and platforms into business financial operations.

Using technology in financial operations aims to enhance decision-making processes and optimize the overall efficiency of business operations. It is key in ensuring that B2B SaaS finance teams can seamlessly manage their accounts receivable and accounts payable processes to ensure steady cash flow.

For B2B SaaS companies, using technology in finance involves ditching the spreadsheets and laborious redundant tasks. Rather than using traditional accounting methods for subscription billing, invoicing, receivables management, cash collection, etc., finance teams are now relying on automation to expedite the financial workflow significantly.

Although using technology in finance makes all the difference, it is not here to replace finance teams, as you may think. Instead, it will only make your work quicker and more efficient.

In the next section, we’ll explore the benefits of using technology in finance and why you should hop on the technology train as soon as possible.

Benefits of Using Technology in Finance

As more technological advancements emerge, it’s clear that it is not only an advantage to use technology in finance, but it is fast becoming a necessity for growth.

Let’s briefly discuss some important benefits of using technology in finance.

Increases Productivity

Implementing technology in finance can play a huge role in increasing your team’s productivity.

Here are some benefits of using technology in finance.

- Revenue recognition: One of the most challenging aspects of running a B2B SaaS company is keeping up with revenue recognition standards. Most B2B SaaS companies provide services based on unique subscription models, which often make it difficult to streamline revenue recognition.

Without technology, revenue recognition would be a tedious process that involves complex spreadsheets and manpower.

However, subscription billing software solutions like Younium automate revenue recognition and ensure your company complies with ASC 606 and IFRS 15 regulations.

- Invoicing: When it comes to invoicing, account receivable teams in B2B SaaS companies are often tasked with the burden of tracking payments, sending invoice reminders, and other tedious processes.

Traditional invoicing involves using basic invoice templates or makeshift invoicing solutions like Excel spreadsheets. The limiting nature of these basic invoicing tools may also make it difficult to scale operations when it's necessary.

Technology makes the cash collection process a walk in the park by automating the entire process. With B2B e-invoicing tools, your accounts receivable team can easily automate the creation and sending of invoices to improve processing time.

Improves Security

Finance teams in B2B SaaS companies deal with confidential customer data, which needs to be completely secure. Technology can help with that.

Here are some of the solutions that help keep your financial data secure.

- Encryption: Encryption prevents potential hackers from accessing or manipulating your customers’ data. This means that any sensitive information you have stored in your systems will remain unreadable without authorized access.

- Multi-factor authentication: This feature requires more than one piece of information to verify who is trying to access sensitive information. In finance teams, it can be used as an extra layer of security that prevents unauthorized access to your customers’ financial data.

Ensures Compliance

As a SaaS company, you must comply with regulations within your industry. This includes financial compliance, security compliance, and data security compliance.

Implementing technology in finance makes it easier for you to ensure regulatory compliance.

For example, as your company grows, you may require more extensive third-party integrations or a change in pricing models to accommodate different invoicing requirements.

This can make it more difficult to keep track of revenue. It may also expose you to multiple breach points. As such, you must remain compliant to keep your data safe and avoid paying fines or facing penalties.

While it can be difficult for your finance teams to maintain compliance, technological advancements are here to help. Using advanced tools like Younium makes it easy to remain compliant and safe in the following ways:

- Younium integrates with other billing gateways and allows you to exchange e-invoices under PEPPOL compliance regulations, keeping you and your customers’ data safe.

- Younium helps businesses track their monthly recurring revenue (MRR) and enable accurate revenue recognition according to ASC 606 compliance regulations.

- It helps you remain financially compliant with taxes by integrating with TaxJar and automates adding sales taxes to invoices.

Reduces Costs

Using technology in finance helps you maximize your company resources using AI and automation to expedite financial workflows. It:

- Reduces operational expenses: Automating accounts receivables can significantly cut down operational costs by reducing manpower associated with manually processing invoices. On average, it costs about $15 or more to process paper invoices. However, with automated invoices, it could cost as low as $3.

- Improves Resource allocation: Another way technology can help reduce costs is by resource allocation and financial planning. Advanced systems can analyze historical data from B2B SaaS business operations and identify areas to reduce costs and manage the company’s resources better.

- Saves time: With automation tools, your finance teams can easily automate repeat tasks, which saves time and reduces manpower requirements, thus saving money.

Applications of Technology in Finance for B2B SaaS Companies

Let’s discuss some specific applications of technology in finance and how you can leverage them to optimize financial workflows in your organization.

Predictive Analytics for Cash Flow Management

One of the most important tools B2B SaaS companies often use to stay on top of their finance game is predictive analytics.

It uses data to identify trends and correlations in financial trends. This information is then used to determine the likelihood of future outcomes in whatever context the data is taken from.

It provides in-depth insights into your company’s cash flow trends and identifies potential loopholes. Based on the results of this analysis, you can make informed decisions to better manage your company’s finances.

Here are some examples of how predictive analytics enhances B2B SaaS business operations.

- Revenue and Cash Flow forecasting: Due to the complex billing models and fluctuating revenue in B2B SaaS companies, it is often difficult and time-consuming to forecast cash flow accurately.

However, using predictive analytics, you can generate accurate cash flow forecasts. You can then use the information to optimize your financial planning processes, anticipate potential liquidity challenges, and take proactive measures to curb financial losses.

- Customer churn: Predictive analytics tools can be used to analyze customer payment patterns and trends and predict customer churn. Customer churn analysis helps you identify at-risk customers and take measures to reduce churn.

- Fraud prevention: B2B SaaS companies often deal with large volumes of transactions, putting them at risk of fraudulent activity and cybercrime.

Predictive analytics models use cognitive computing and machine learning to analyze data patterns and detect real-time spam or anomalies. These models use advanced screening tools to check customers’ transactions and ensure they always remain compliant with anti-money laundering regulations.

RegTech for Compliance and Risk Management

Finance teams of B2B SaaS companies often deal with huge volumes of transactions and must keep up with certain compliance regulations.

These compliance regulations are put in place to protect customers' data and curb financial crimes. However, it can be overwhelming to keep up with as the number and complexity of financial transactions increases.

Some of the major challenges CFOs of B2B SaaS face in achieving compliance include:

- Keeping up with the constantly evolving compliance requirements according to ASC 606 and IFRS 15 regulations

- Maintaining compliance as the company grows

- Keeping up with tax requirements

To help with this, a form of technology in finance called Regulatory Technology (RegTech) enables finance professionals to automate compliance processes.

Here are some ways in which RegTech helps B2B SaaS companies remain compliant with regulations.

- Automatic compliance: SaaS accounting software solutions like Younium only process data according to GDPR requirements to keep your customers’ data safe from unauthorized access.

- Tax compliance: Rather than struggling with tax calculations, you can use software solutions like Younium to automate tax calculations. Such tools also help ensure tax compliance according to the state or region in which your company operates.

- Risk assessment: RegTech platforms use, machine learning, automation, and data analytics to monitor and streamline regulatory compliance. They use risk assessment tools to help B2B companies identify and manage the risks associated with their customers' data.

Robotic Process Automation (RPA)

RPA helps finance teams in B2B SaaS businesses through automatic invoice processing. It is one of the repetitive tasks in the financial departments of B2B SaaS companies. It can also be time-consuming and overwhelming.

With tools like Younium, invoicing can be automated and streamlined. It uses advanced systems to automate invoice reminders, invoicing, and billing.

This significantly reduces the time and resources required for manual data entry and allows finance teams to focus on more strategic tasks, enhancing overall productivity.

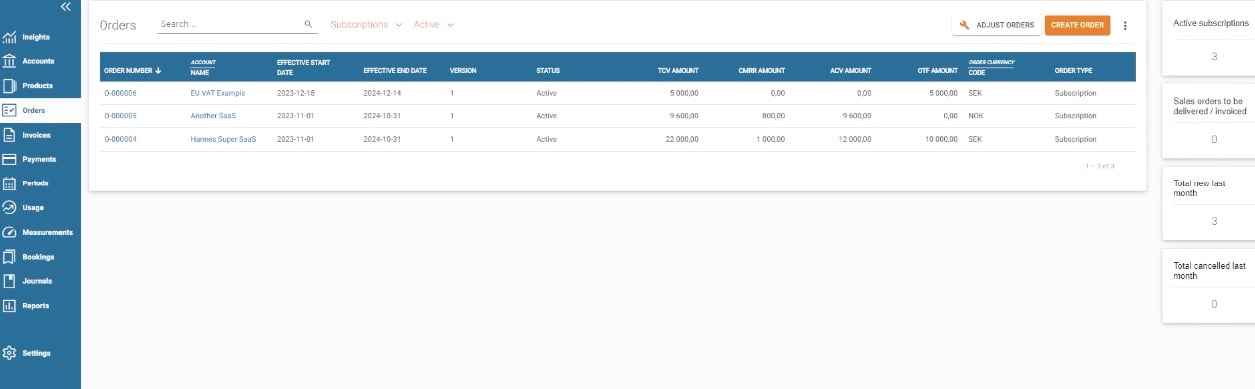

Take a look at Younium’s simple dashboard for creating and managing invoices.

Image via Younium

Cloud-Based Financial Management Systems

Cloud-based financial management systems centralize financial data, making it accessible anywhere. Cloud-based systems enhance flexibility, allowing finance professionals to enjoy seamless collaboration.

A good example of cloud-based financial management software that streamlines finance operations in B2B SaaS companies is Younium.

It streamlines subscription management, billing, invoices, and other features that elevate customers’ payment experience. Here are some of the unique features it offers:

- Automates the billing cycle, including automatic invoices, dunning, and payment collection.

Image via Younium

- Eliminates the need for bulky spreadsheets and tools and manages advanced subscription data on an easily accessible database.

- Streamlines accounts receivable (AR) processes by creating billing schedules according to specific dates and times. This way, billing reminders for usage-based pricing are sent out faster, and cash flow is managed better.

- Automatically calculates and validates your customers’ usage for more accurate billing.

Wrapping Up

Technology is pivotal in transforming traditional financial practices, offering solutions that cater specifically to the unique needs of B2B SaaS operations.

While technology in finance may be here to stay, it cannot completely eliminate the need for finance professionals like you. As such, it is best to embrace it and leverage it to keep your business running like a well-oiled engine.

Looking for an all-in-one subscription management software to streamline finance and other aspects of your SaaS business? Try Younium.

FAQs

Q1. How is technology being used in finance?Technology is being used to simplify several aspects of finance in the following ways:

- Business Process Automation: Business process automation eliminates manual invoicing, data entry, and other redundant tasks.

- Cloud-based systems: These help with collaboration, scalability, and flexibility across finance teams.

- Cybersecurity: Technology in finance can be used to facilitate faster and more secure online payments while protecting your customers' data.

- Data analysis: You can employ advanced data analytics tools to monitor the profitability of your business and make data-driven decisions.

- Regulatory technology (RegTech): RegTech helps finance professionals ensure that financial transactions are done in compliance with regulations.

With each day that passes, it becomes increasingly clear that technology in finance is here to stay as it offers an endless list of benefits for the future.

The future of technology in finance holds exciting possibilities, driven by continuous advancements in digital innovation. Some technologies and solutions to watch out for include:

- Blockchain and decentralized finance

- Subscription management solutions

- Artificial intelligence and machine learning

- Quantum computing

- Digital identity solutions

- Enhanced cybersecurity measures

- RPA expansion

- Augmented reality and virtual reality applications

- Regulatory tech (RegTech) advancements

- Cybersecurity

Also known as Fintech, financial technology refers to the use of technology to enhance or automate the financial aspect of a company’s business operations. Its aim is to optimize financial processes and lead to more secure data management.

Subscription management solutions are critical in finance technology as they streamline billing, invoicing, and revenue recognition processes. By automating these functions, they reduce manual errors and save time, allowing finance teams to focus on strategic tasks. These solutions also provide comprehensive analytics and reporting, helping businesses make data-driven decisions and maintain compliance with financial regulations.

Q5. Where does Younium fit in the tech stack?

As a subscription management solution designed for B2B SaaS companies, Younium is positioned as a central component of the finance tech stack. It connects seamlessly with other systems including CRMs, ERPs, and payment gateways, creating a unified platform. This integration capability makes Younium a core hub for managing subscriptions, delivering a single source of truth, and offering valuable insights through advanced analytics. In Ben Murray's 2023 and 2024 annual reports on SaaS tech stacks, Younium is highlighted as a key player in revenue recognition, BI/analytics, and invoicing software.

Q6. How does Younium handle revenue recognition and compliance?

Younium simplifies revenue recognition with its built-in capabilities aligned with critical accounting principles and standards, including the revenue recognition principle, ASC 606 revenue recognition, IFRS, and more. It offers automated processes tailored to B2B SaaS needs, ensuring effortless compliance and precise revenue allocation. Younium provides a fully integrated revenue recognition solution built directly into the platform, without the complexity of external add-ons.