Essential Subscription Revenue Recognition Strategies

Wondering how subscription revenue recognition works, when to recognise revenue, and why? From the metrics to scenarios, this post outlines what you must know.

This post was last updated on January 27, 2025.

Jump to read

What is Subscription Revenue?

What is Subscription Revenue Recognition?

Why it’s Important to Recognise Subscription Revenue

Metrics to Understand for Subscription Revenue Recognition

Cost of Goods and Services in a Subscription Business

Deferral Method vs. Accrual Method of Accounting

Challenges of Revenue Recognition for SaaS Companies

Subscription Revenue Recognition Scenarios

Frequently Asked Questions

Revenue Recognition Doesn’t Have to Be Complex

Subscription revenue recognition differs significantly from traditional methods and comes with its complexities.

For subscription-based businesses, accurate revenue recognition is crucial for proper financial reporting and understanding business performance.

Unlike one-time sales, where revenue is recognized immediately, subscription models involve recurring payments and often upfront fees for services delivered over time. This complexity calls for a deep understanding of revenue recognition principles and processes.

Moreover, proper subscription revenue recognition affects multiple aspects of a business, from financial statements to departmental performance metrics.

To navigate these challenges, businesses must comply with specific subscription revenue recognition standards and adapt to evolving subscription billing models.

This guide explores essential concepts, SaaS metrics, and scenarios to help you master subscription revenue recognition. And if you’re dealing with multiple revenue streams or otherwise ready to streamline your processes, request a demo of our software today.

What Is Subscription Revenue?

Before going any further, you need to understand what subscription revenue is and how it differs from regular revenue.

Customers sign up for services or products, such as software, streaming services, and more, in advance. They get billed recurrently at set intervals over a chosen period. This could be monthly, quarterly, or annually.

Another scenario would be when companies sign contracts and commit to making future payments for products or services for a set period. These are both common in the SaaS B2B software market.

Subscription revenue banks on customer retention as opposed to making one-time sales. This makes revenue more consistent and easier to predict. For this reason, subscription models are a preference for most SaaS companies.

Subscription revenue provides an easier way for businesses to scale faster. Here are reasons why the subscription model is effective for SaaS businesses.

- Revenue forecast: Businesses can forecast subscription revenue more accurately and roll out their financial plans.

- Tracking important metrics: They can also easily track SaaS metrics and identify problems early enough. Metrics like monthly recurring revenue and annual recurring revenue become clearer when subscription revenue recognition is done right.

- More avenues for revenue collection: Subscription billing offers different avenues to explore a company’s revenue with flexible payment options. For instance, a company selling software can easily have custom plans.

With these, clients can choose the features they need and pay only for those. This reduces the chances of clients canceling subscriptions due to a lack of suitable plans.

- No hidden charges: There are no hidden costs and charges for customers. What they see in the packages is what they get. Some have add-ons for extra features, but these are options that get listed up-front. This enables a client to plan their costs. And that makes the subscription model profitable for businesses.

So what is subscription revenue recognition?

Find out in the next section.

You May Also Like:

What Is Subscription Revenue Recognition?

Revenue recognition is a Generally Accepted Accounting Principle (GAAP) that helps companies know and account for their revenue. This includes actual revenue, deferred revenue, and liabilities.

Actual revenue according to generally accepted accounting principles refers to revenue that has been earned.

Revenue recognition is typically done when a product is delivered or service fulfilled, as opposed to when money is received.

Subscription revenue recognition is a section of the larger revenue recognition regulations by generally accepted accounting principles.

With subscription-based businesses, upfront payment may be required, and they receive money before services have been delivered. So, it’s important that subscription revenue recognition happens only after a service is delivered.

That makes it important to understand the difference between money earned and money received. You may receive the money before you provide your SaaS product to your customers.

However, the process of generating revenue becomes complete only when the subscription period is over. When the contract obligation from your end is fulfilled, then your revenue is considered earned. That’s when subscription revenue recognition occurs.

For instance, if a company makes a subscription for a software plan priced at $25 paid annually and they pay $300 upfront, you can only recognise $25 at the end of every month as revenue.

Why is subscriptionrevenue recognition important? This next section explains more.

Why Is Subscription Revenue Recognition Important?

Revenue is crucial to determining any business’s profitability. Overstating or understating it leads to false financial figures and inaccurate financial predictions.

As a result, subscription revenue recognition impacts every aspect of a business’s operations. Proper subscription revenue recognition ensures the accuracy of the company’s profit and loss statements.

Accurate subscription revenue recognition also helps manage a company’s operational and capital expenditure. If you recognise revenue before it's earned, you risk making expensive investments your business may not be able to afford.

The opposite is also true. If you understate your revenue, you can miss out on profitable investment opportunities.

Other benefits of accurate subscription revenue recognition are:

- When seeking investors and funding, you’ll need to share your company’s true financial position. Accurate subscription revenue recognition can help with that.

- You’ll accurately perform corporate tax calculations and comply with tax laws. Corporate tax calculations are based on your earnings, therefore if your revenue is under or over-stated, then you risk filing taxes inaccurately.

- It’ll ensure compliance with the ASC 606 subscription revenue accounting standards and IFRS 15 laws for B2B subscription-based companies.

In short, your company’s overall financial health depends on how accurately you recognise and report your revenue. Therefore, you need to know how to recognise revenue correctly.

Metrics to Understand for Subscription Revenue Recognition

Before diving into the exact subscription revenue recognition principle, here are commonly used subscription metrics related to revenue that you need to understand.

Deferred Revenue

This refers to money billed from customer subscriptions for which services haven’t been fulfilled yet. It’s also commonly referred to as unearned revenue in subscription revenue recognition terminology

Deferred revenue is considered a liability; you’re yet to fulfill your obligation to provide a product or service that your customer has already paid for.

Failure to perform this obligation or if the customer cancels their subscription midway, you’d be obligated to make a refund. This is, of course, if the contract between you and the client states so.

Unbilled Revenue

This refers to revenue that has been earned, but a customer has not been billed for it yet. Since the company has already met its end of the obligation to provide a service, unbilled revenue can be recognised.

Unbilled revenue is therefore considered an asset, i.e., included in the accounts receivable.

The revenue could be unbilled due to contract terms between the company and clients.

Monthly Recurring Revenue and Annual Recurring Revenue

Subscription revenue is characterised by recurring revenue, charged monthly or annually. ARR is revenue from annual subscriptions while MRR is revenue from monthly subscriptions.

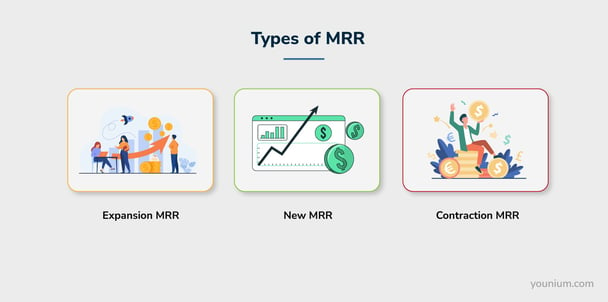

There are different types of monthly recurring revenue, including

- Expansion MRR: This refers to additional monthly recurring revenue from upgraded subscriptions.

- New MRR: This refers to monthly recurring revenue from newly acquired subscriptions in a specific period.

- Contraction MRR: This refers to reduced monthly recurring revenue either from downgrades, discounts, cancellations, lost businesses, non-renewals, or removed add-ons.

Billings

These refer to the amount that customers pay as costs for their subscription services. It’s the amount that you invoice your customers at regular intervals, depending on your agreement.

The subscription model thrives on automated upfront billings. A business with consistent billings has better financial health as opposed to those that have constant bookings, as explained below.

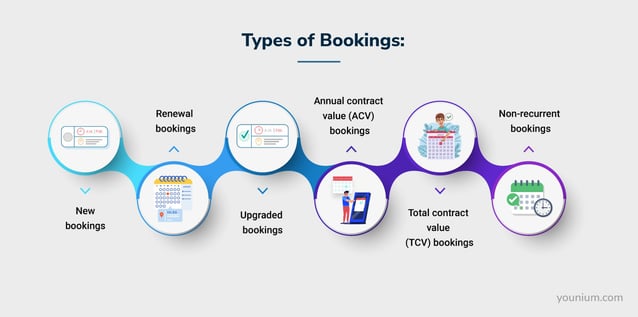

Bookings

These are contracts of commitment by customers to pay for products or services at a future date. There are different types of bookings.

- New bookings: These refer to bookings from new customers.

- Renewal bookings: Refer to bookings from subscription renewals.

- Upgraded bookings: Refer to bookings from contract upgrades

- Annual contract value (ACV) bookings: These are bookings that have at least a year’s commitment to stay subscribed to a product or service.

- Total contract value (TCV) bookings: You calculate this using the total duration a contract is meant to last.

- Non-recurrent bookings: These are contract bookings for one-time fees, for example, set-up fees or discount fees.

Bookings help forecast a business’s growth in revenue. It’s an important planning metric for finance teams as it enables them to predict cash inflows and outflows.

However, it’s a poor indicator of your financial health if your bookings exceed your actual billings. This is because you haven’t received the money yet, it’s only promised at some point in the future.

You’d thus need strategies to ensure clients make payments upfront. There needs to be a balance between the two forms of revenue.

So, how do you report bookings?

You can report them as promised money as opposed to labelling them as revenue. This way your ARR and MRR remain accurate.

Revenue

This is income earned when a product or service is provided to your customers. In a subscription billing setup, you can recognise amounts monthly after the subscription period is over, as opposed to when you send an invoice.

The Generally Accepted Accounting Principles determine how to do subscription revenue recognition. Unlike bookings and billings, revenue gives you an actual picture of how much your business is worth.

While billings and bookings are important to track for prediction and planning, your true performance assessment lies in subscription revenue recognition.

You May Also Like:

- SaaS revenue data insights and efficiency metrics

- Subscription Metrics Part 2: Difference between MRR & CMRR?

Cost of Goods and Services in a Subscription Business

In a regular business model, the cost of goods sold refers to the direct costs for producing goods sold by a company. This includes things like materials used and direct labour.

The cost of goods sold helps businesses track the revenue that’s left to cater to indirect costs.

What does that mean for a SaaS business?

In SaaS businesses, it’s not easy to identify the direct costs. But it’s important to identify these costs to understand how much money you’re spending for running your business, and more importantly, where you’re spending it.

It’s the only way through which you’d be able to determine its profitability.

Here are examples of these expenses. You’ll need to determine which of these are a part of your direct costs.

- Hosting fees for customer accounts

- Customer support

- Payment gateway fees

- Licensing fees

- Merchant fees

- Cost of software and tools

Expenses not critical to the subscription service provision should not be included in the cost of goods sold. These include.

- Sales commissions

- Product development costs

- Upselling/cross-selling costs

You May Also Like:

Deferral Method vs. Accrual Method of Accounting

The complexities of subscription revenue recognition result from a dynamic technological environment.

With traditional software acquisition, revenue recognition wasn’t recurrent as software updates were few. Additionally, the payment was typically made once.

Also, acquiring software was as easy as buying an off-the-shelf disc, paying cash, and transferring its contents to your hard disk. With this, there was little to no deferred revenue or accrual accounting.

Currently, with constant software updates and the ability to upgrade (or downgrade) to better features, recurring billing has become a preference. It also reduces the cost of the product for the customer. To track this recurring spend internally, many businesses rely on sophisticated expense management software.

Hence there’s a need for accrual accounting and tracking deferred revenue.

As mentioned, revenue is earned when a product or service is delivered, in this case, when a subscription period lapses. Recognising unearned revenue comes with liability issues if and when clients:

- Cancel their subscriptions

- Have complaints about products and demand refunds

- Decide to downgrade their subscription to a cheaper plan during the subscription period

So, how do you recognise your revenues or expenses?

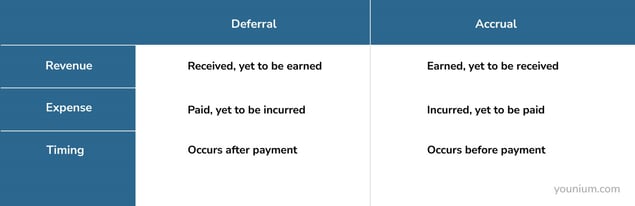

There are two methods — accrual and deferral.

Deferral Method

Subscription businesses always receive payments before they can earn them. So, you can account for these once they’re earned, as mentioned previously in this post. That is, you account for them as revenue each time a subscription period ends.

Similarly, you account for your expenses when you’ve already paid them but are yet to incur those expenses by getting the said products or services. Essentially, you’ve paid cash in advance.

Accrual Method

Accrual accounting, on the other hand, is the exact opposite. You record the revenue when it’s been earned but not received. That is, you’ve provided the services but are yet to receive cash for them.

Similarly, the expenses are recorded when you have already incurred them, even if you haven’t yet paid.

Both these methods are best suited to the subscription business model and you can choose to stick with one for subscription revenue recognition.

Besides deferring and accruing revenue, there are principles of subscription billing management every business should comply with. These are the ASC 606 principles that were formed to streamline subscription revenue recognition.

This next section takes an in-depth look at these provisions for subscription revenue recognition.

You May Also Like:

- Optimising Your Financial Workflow: Younium's Advanced Accounts Receivable and Payment Solutions

- How to Streamline Financial Processes with Subscription Billing Platforms

Subscription Revenue Recognition with ASC 606 and IFRS 15

As mentioned, subscription billing and subscription revenue recognition have grown more popular due to the proliferation of SaaS platforms. This led to the establishment of accounting principles to streamline revenue recognition across SaaS companies and other industries with complex or multiple revenue models.

These principles include the Accounting Standard Codification (ASC) 606 and International Financial Reporting Standards (IFRS) 15. The two standards were created by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), respectively.

ASC 606 outlines the principles for businesses that enter into any form of contract with customers to provide goods and services. Similarly, IFRS 15 contains standards governing revenue from businesses in the aforementioned contracts.

Subscription revenue recognition falls under these two regulations. While ASC 606 and IFRS 15 are largely aligned, there are some key differences:

- ASC 606 is primarily used in the United States, while IFRS 15 is adopted by many countries worldwide.

- IFRS 15 provides more flexibility in certain areas, such as contract modifications and licensing arrangements.

- Disclosure requirements differ slightly for the two standards.

Despite these differences, both standards aim to improve comparability across industries and provide more useful information to financial statement users.

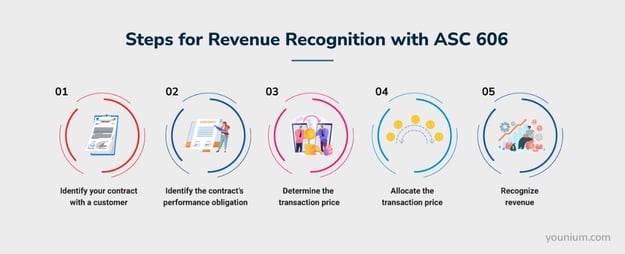

These two sets of regulations were created to ensure companies are managing recurring revenue from subscriptions more accurately and easily. They outline a five-step guide to subscription billing that fits any form of recurring revenue recognition.

These steps include:

- Identify your contract with a customer

- Identify the contract’s performance obligation

- Determine the transaction price

- Allocate the transaction price

- Recognise revenue

Let’s look at each step in detail.

1. Identify Your Contract with a Customer

This involves knowing the criteria for getting into a subscription contract with your customers for your products and services. The contract can be in written form, oral, or implied as long as the agreement between the company and the customer is mutual.

It should be for a commercial transaction and must be approved by both participants as such. The customer must also show intention to pay within a certain period. This is called consideration.

What’s more?

The terms of the contract may be subject to modification. When modifications are made to the terms of a contract, you can either create a new contract or modify the old one to reflect the changes.

Modifications that may lead to the creation of a new contract include:

- If a customer asks for additional units of a product or service. These additional units could also be counted as an upgrade with more features of the SaaS platform. This is considered a new obligation that is different even if it’s the same product.

- If the additional units (upgrades) ordered have a separate selling price and would typically be sold in the market as a standalone item. For instance, if a customer upgrades to a higher-tier plan.

The contract remains the same if:

- Changes in pricing for the existing performance obligation constitute a modification e.g. if the customer negotiates for a discount.

- If there are no additional products and services ordered by the customer.

2. Identify the Contract’s Performance Obligation

When a customer subscribes to a product or service, the owner of the software or service gets into a contract with the customer to provide the said goods or services.

The contract also becomes a performance obligation if the goods and services being provided are distinct. A product or a service is distinct if:

- It provides benefits to the customer on its own or as a part of other available resources.

- The entity's promise to provide a product or service to the customer is distinct from other promises in the contract.

A performance obligation is not considered distinct if:

- The seller has to integrate your goods and services significantly with other goods and services for performance.

- The products and services you provide are interdependent (not independent).

- The goods and services you provide are a significant modification of the existing products or services.

If the performance obligation is not considered, you’ll need to bundle up goods and services and provide them as a combined package to make them distinct.

Why Identify Performance Obligation?

This is a question that’ll likely pop up in your head. The prime purpose of identifying performance obligations is to identify different forms of revenue realised.

Bundling and unbundling your performance obligation will help you identify these different forms of revenue realised and recognise them separately.

For instance, some packages come with marketing incentives at the time of subscription. This could be, for instance, an add-on feature for a specific premium package, not available in other plans.

Subscription revenue recognition resulting from such performance obligations should be done separately from the main obligation of the contract. This would help you identify the revenue arising from it.

Usually, revenue recognition for add-ons is mostly done when billed. For the remaining obligations, you’d need to conduct revenue recognition when revenue is earned.

You May Also Like:

- How to evaluate contracts for your subscription business

- Matching pricing arrangements to your subscription contracts

3. Find the Transaction Price

Transaction price refers to the amount that the company expects to receive for meeting its performance obligation. This amount depends on the value a company attaches to its product or service, as well as other financial incentives.

This transaction price may change from time to time during the contract based on the upgrades or downgrades by the customer and this affects how you recognise subscription revenue.

When determining transaction prices, here are items you need to consider:

- There may be variable considerations due to discounts, refunds, incentives, penalties, bonuses, and price adjustments.

- You’ll recognise variable considerations when it’s highly likely that there will be no significant reversal in the cumulative amount of subscription revenue recognition to date.

- If you’re expecting a refund, you can’t recognise payment received as revenue. Instead, you’ll create a provisional asset account and make adjustments to your cost of goods sold to account for the refund.

If there’s a significant time gap between the provision of a product or service and when payment is received, you’ll need to make adjustments for the effects of the time value of money. However, you'll not need any adjustments if services are provided and paid for within a year.

This goes for both cases — service is provided earlier or the payment is made earlier.

The only difference?

If the payment is received in advance, you’ll record a finance expense and recognise the payment as deferred revenue. If payment is made later, you’ll record a finance income and accrued revenue.

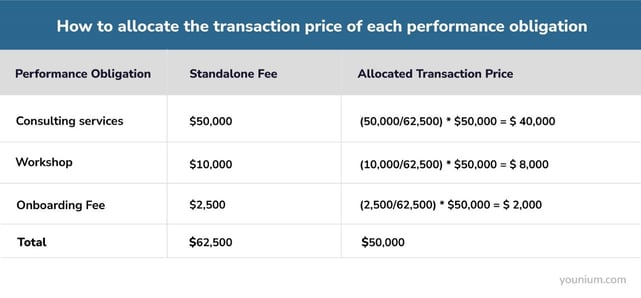

4. Allocate the Transaction Price

After determining your transaction price, you’ll need to allocate it to your performance obligation. This includes both the allocation of the price and discounts associated with the obligation.

The transaction price is allocated based on the independent selling price of each performance obligation within a contract.

For instance, note how the transaction price below is split up into the various goods and services. There’s a transaction and selling price for each of them too.

The transaction price is supposed to depict the value your company feels entitled to for providing goods and services as promised in the contract.

With discount allocation, ASC 606 requires that it be proportionate to all performance obligations within the contract. This is unless the discount is specific to a particular performance obligation.

This could be if a vendor largely sells distinct products, services, or bundles of the same, as standalone items.

You do not need to allocate a transaction price if your contract contains only one performance obligation.

What’s more?

When you modify a contract for any reason stated earlier, you’ll also need to reassess your transaction price allocation.

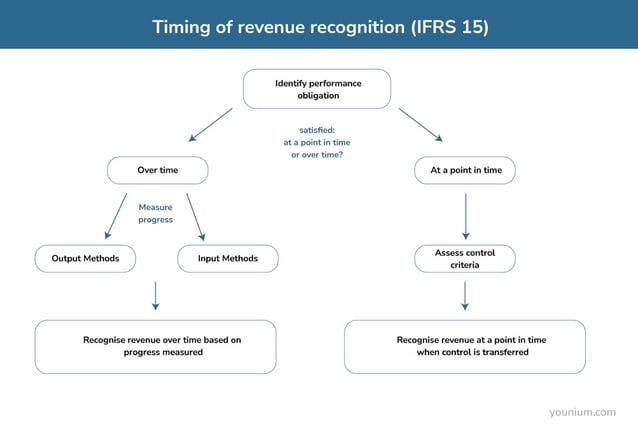

5. Recognise Revenue

You can only recognise revenue when each performance obligation in your contract is satisfied. A performance obligation is satisfied when you provide the product or service as indicated in the contract.

This could happen once or regularly over time depending on how you identify your performance obligation.

Subscription Revenue Recognition Over Time

Performance obligation can be identified over time if:

- You provide the product or service while your customer simultaneously receives and consumes it. For instance, subscription-based streaming services.

- You create or enhance an asset as the customer simultaneously controls it.

- You create an asset you don’t have an alternative use for, either since it was specific to a customer or you’re restricted from using it, etc, but you have an enforceable right to payment for work completed so far.

When recognising revenue over time, you base it on your progress toward satisfying the performance obligation. You can measure this progress in various ways including:

- Output methods: This measures the direct value your products and services provide to your customers. It may be determined by milestones, units delivered, and time-lapsed.

- Right-to-invoice: Here, an entity has a right to invoice the customer according to the value they’ve provided so far.

- Input methods: These may include basing your revenue on labour hours worked, resources consumed, etc.

If you’re unable to measure the progress of your performance obligation, ASC 606 provides that subscription revenue recognition be done based on the extent to which you’ve incurred costs.

Subscription Revenue Recognition At a Point in Time

This is the default provision for recognising revenue by the IFRS. Here, you’ll have to determine the point when the performance obligation of the contract is satisfied.

This refers to when the customer gains control of an asset and can direct its use. At this point, your entity obtains the enforceable right to payment and you can recognise your payment then. It’s the point where the ownership of the product or service is transferred to the user along with the risks and perks that come with it.

You May Also Like:

- Revenue Recognition for SaaS Under IFRS 15 and ASC 606

- The Pitfalls of Revenue Recognition in Spreadsheets

Challenges of Subscription Revenue Recognition for SaaS Companies

While a subscription-based model offers flexible avenues to charge revenue, it also comes with billing issues and subscription revenue recognition challenges. As you may have already understood, subscription revenue recognition isn’t very straightforward when it comes to the subscription model.

Here are the most common challenges SaaS businesses can face for revenue recognition.

Flexible Subscription Plans

With flexible subscription options comes the freedom for customers to switch between billing cycles and packages.

A customer can switch from a monthly plan to an annual one, downgrade or upgrade between plans, and add or remove users — the options are plenty.

This means that your performance obligations will change regularly and so will the customers’ payment intervals. This makes subscription revenue recognition challenging as you’ll always have to make adjustments to accommodate these changes.

In some instances, clients may cancel their subscription mid-way. And if their contract states that they can get a refund or be charged a cancellation fee, then this would impact your subscription revenue recognition at the end of the subscription. The calculation can be quite messy.

Varied Contract Types

SaaS companies offer different contract types including fixed and multi-tiered plans. The most confusing ones, though, can be custom plans. With such plans, clients get to choose features according to their specific needs, and the costs for these would be unique in each case.

What’s more?

While this is crucial for attracting customers, it poses various subscription revenue recognition challenges. You’d need to have customised contracts for each client to comply with each of the five subscription revenue recognition stages discussed above.

This makes it all the more difficult.

You May Also Like:

- Managing multiple subscription contract types at once

- How contract types can impact ability to scale your busines

Added Features and Services

When selling products, most SaaS companies provide optional additional features along with the main product and charge additional fees for these. These include service fees, support fees, consultation fees, etc.

In such cases, you’d have to follow the recommended ASC 606 model as discussed. That means you’d have to provide distinct goods and services or bundles of the same for your performance obligations to be compliant.

If you choose to add discounts to such services as incentives, there are subscription revenue recognition laws you’d have to comply with too.

Multiple Products

For each different product and service you provide, you’ll need separate contracts.

Your distinct products could also be a part of a single contract but they’d have to be priced and tracked differently as they’ll be categorised as separate performance obligations.

This gives your finance team numerous streams of revenue to track.

Time-Consuming Process

For revenue recognition for subscription billing, accountants have to monitor different contracts, comply with various rules, and track numerous revenue streams. This can be hard and time-consuming.

In such a case, using spreadsheets doesn’t cut it. You’ll need to have a reliable subscription management solution like Younium to automate parts of these processes and simplify them.

Evolving Regulatory Compliance

Adhering to evolving regulatory standards significantly complicates subscription revenue recognition for SaaS companies.

As global accounting frameworks like ASC 606 and IFRS 15 continue to develop, businesses must constantly update their subscription revenue recognition practices to remain compliant.

This challenge is amplified by the complex nature of SaaS offerings, which often involve multi-year contracts, varied pricing models, and recurring billing cycles.

Ensuring accurate subscription revenue recognition across different jurisdictions, each with its own reporting requirements, adds another layer of complexity.

SaaS companies must invest in robust systems and expertise to maintain precise financial records, correctly recognise revenue, and avoid potential legal and financial repercussions of non-compliance.

So what does subscription revenue look like for SaaS software companies?

Let’s find out.

You May Also Like:

- How to fix revenue leakage in a recurring revenue business

- Navigating Cash Flow Challenges: Insights from a SaaS CFO

Subscription Revenue Recognition Scenarios

This section discusses real-life subscription scenarios and how you can recognise the revenue in each case.

License Subscriptions

Here, customers pay for services at intervals, say monthly, and your system generates an invoice for them. The payment is made upfront and services are provided as per intervals paid for.

For instance, on March 20th, a customer subscribes and pays for a $62 monthly service to expire on April 19th. The subscription revenue recognition breakdown for this payment would be:

- At the end of March, the recognised revenue is $24. This is the value equivalent to the service provided in March.

- The remaining $38 is recorded as deferred revenue to be recognised in April

Metered Subscriptions

With metered subscription services, you provide products or services in advance and bill after all subscription revenue recognition is done. Going by the timeline in the example above, you’ll generate an invoice for your client on April 19th.

Assuming similar rates, at the end of March, you’ll still recognise $24 as revenue for March, but debit it to unbilled accounts receivables. You’ll not debit your accounts receivable, though, as you haven’t invoiced this payment yet.

By the end of April, you’ll recognise the full amount of $62 as revenue and debit it to accounts receivable. By then, you’ll have billed this payment to your customer.

Subscription Upgrades and Downgrades

Customers can choose to upgrade or downgrade their subscriptions before the end of their billing cycle. In this case, you’ll need to adjust how you recognise revenue.

For instance, a customer subscribes to a $30/month package on June 1st. They get a finalised 30-day invoice for their payment.

However, on the 15th of the same month, they upgrade to a $60/month package, and again an invoice is generated for the month.

The difference?

This second invoice is running for the remaining 15 days after the previous subscription was terminated.

Here, the subscription revenue recognition for June will be $15 for 15 days of the initial subscription and $30 for the 15 days of the second subscription.

The same case applies to subscription revenue recognition for downgrades.

Uncollectible Invoices

These are payments that you do not expect to get. Here, you’ll clear the accounts receivable. If the subscription revenue recognition has already happened, it’s written off as bad debt.

If the revenue was deferred, then the deferred revenue account will be cleared as well.

You may still receive payment for uncollectible invoices. In this case, you’d clear part of your bad debt accounts that recorded the amount as a write-off.

Cancellation with Refund

Here, a customer cancels a plan, say an annual plan, mid-way. They already paid their annual fees for the subscription, therefore will have to get a refund for the remaining period.

For instance, a $1200 annual subscription was supposed to run from January to December, but the customer canceled in May.

Here, you’ll recognise your revenue until the end of April. Then, you’ll create a credit note for the remaining $800 and refund the amount to the customer in the case of a full refund.

Cancellation Without Refund

Going by the above example, the customer will cancel on May 1st. You’ll then recognise the $100 amount in April just like you did for the previous months

But since your contract does not provide for refunds to the client, the remaining $800 can be recorded as deferred revenue to be recognised in May.

Annual Plans

Here, the customer commits to an annual plan for 12 months. They will get an invoice, billing them for the 12 months for say $1,200.

They’ll make the payment and you’ll collect it, but you can only recognise these amounts monthly. So at the end of January, you’ll recognise $100. This is, of course, assuming that the subscription begins on 1st January.

In January, the remaining $1,100 is recorded as deferred revenue, to be recognised at intervals as the year progresses. By December, you’ll have your full-year revenue recognition and you’ll have fully satisfied your performance obligation.

You May Also Like:

- How to Create a Subscription Revenue Model Template

- Forecasting Subscription Revenue: How to Do It Right

Best Practices for Subscription Revenue Recognition

Implementing effective subscription revenue recognition processes is crucial for financial accuracy and compliance. Here are some best practices to consider.

- Automate your subscription revenue recognition process: Leverage specialised software like Younium to automate subscription revenue recognition calculations and reduce manual errors. This improves accuracy and saves time and resources, allowing financial teams to focus on analysis rather than data entry.

- Regularly review and update your revenue recognition policies: As subscription businesses evolve and introduce new products or pricing models, ensure your subscription revenue recognition policies stay current. Conduct regular reviews to align with the latest accounting standards.

- Implement strong internal controls: Establish robust internal controls to maintain the integrity of your subscription revenue recognition process. This includes segregation of duties, regular audits, and clear documentation of all revenue-related decisions and calculations.

- Educate your team: Ensure all relevant team members, including sales, finance, and customer success teams, understand the basics of recognising revenue. This cross-functional knowledge can help prevent misalignments and improve overall your company’s financial health.

- Maintain detailed documentation: Keep comprehensive records of all contracts, performance obligations, and subscription revenue recognition calculations. This documentation is crucial for audit trails and demonstrating compliance with accounting practices and standards.

- Consider the impact of contract modifications: Develop a clear process for handling contract modifications, such as upgrades, downgrades, or early terminations. These changes can significantly impact subscription revenue recognition and require careful consideration.

You May Also Like:

- What is SaaS Analytics and Which Metrics Should You Track?

- What is SaaS Billing? Best Practices and How-To Guide

FAQs

1. How do you recognise subscription revenue?With a subscription, revenue recognition is done once the performance obligations are met. This means that you can only recognise revenue for services and products delivered, even if you receive payment upfront.

Using a subscription management system like Younium, you can effectively and accurately recognise revenue, while following the regulatory standards. It can help remove the complexities of subscription revenue recognition and make the process much simpler for B2B SaaS companies.

2. Are subscriptions accounts receivable?Subscription revenue is considered an asset and debited to the accounts receivable when earned and not billed. This means that you’ve provided the product or service, and therefore can recognise the revenue, but your customer has not paid for it yet.

3. Is subscription revenue deferred?Deferred revenue is a common entry with subscription-based billing methods. This is because, when payments are received but not earned, they cannot be recognised as revenue. They’re therefore treated as deferred revenue to be recognised later.

4. Is subscription revenue the same as ARR?Annual recurring revenue (ARR) only recognises recurring revenue from your subscriptions annually. Subscription revenue, in general, refers to all the revenue received by your subscription business, including additional fees and add-ons.

5. Can you recognise revenue before invoicing?Revenue recognition before invoicing is possible if the revenue has been earned. This means that you’ve already completed your performance obligation before invoicing your customers.

Subscription Revenue Recognition Doesn’t Have to Be Complex

Subscription revenue recognition is an important part of running a SaaS business or any other subscription-based business. While the process is straightforward for a traditional business model, it gets complicated for subscription-based business models, which tend to have different pricing models too.

This can make accounting and revenue recognition difficult. But with the right subscription management platform, you’ll be better placed to recognise your subscription revenue. This, in turn, will give you an accurate view of your company’s financial performance.

Get your free demo of Younium now to understand how it can help manage your SaaS business.