Jump to read

The market still has interested VCs

What matters to investors in 2022 and beyond?

Top 11 tips to raise Series A funds in a ‘funding winter’

Bonus: Are you tracking subscription data yet?

Final word

“Unbelievable – a venture capitalist (VC) asked for 49% equity for a small pre-funding round.”

“Our enterprise value was cut in half!”

“It's just impossible to secure funding nowadays.”

Hearing similar comments a lot more, of recent?

While navigating the ugly macroeconomic conditions of 2022, what is becoming increasingly clear is that there is no ‘easy money’ on offer anymore.

As an entrepreneur, faced with this grim reality, you must be wondering how to secure that elusive initial stage funding.

We don't claim to have a silver bullet, but there are smart platforms and frameworks that significantly improve your chances of securing favorable funding even in a slower economy.

In today’s article, we help you get into the minds of VCs for some such practical fundraising tips in 2022-23.

The market still has interested VCs

Gone are the days when tech companies could attract aggressive investors with nothing more than a jazzy presentation or helpful contacts.

The good news though is there are still seed fund opportunities for data-led and future-focused companies.

All they expect in return is proof of significant commercial traction - proof of your ability to weather the storm.

To pass this investment litmus test, your company should invest in a subscription management software that will diligently track and measure subscription metrics or KPIs that reflect the health of your business. These insights also allow you to recognize problems and opportunities and course-correct to achieve sustainable growth.

What matters to investors in 2022 and beyond?

In a recent webinar, Armand Naessens, Investment Analyst at Netherlands based venture capital company Newion, stated that VCs are being more risk-averse with doling out money for one reason: they need to give at least 5X back to their own investors - a tough ask in today’s economic climate.

To ensure that the B2B SaaS businesses under evaluation can deliver such powerful return on investment (ROI), there are two major factors that VCs must consider:

- Improved valuation: What is the total economic value (current and potential) of your business? If your SaaS company has the potential to grow significantly, in a market large enough, it will surely catch the eye of VCs.

- Improved capital efficiency: Capital efficiency symbolizes how scalable your organization is and how clear are its growth plans. When funding is not easily available, capital efficiency has to counterbalance high-growth strategies. So, be sure to calculate customer acquisition cost (CAC) to understand how expensive your growth is. Capital efficiency should also be able to predict whether your business can stay profitable in the future, should you choose to reduce investments in marketing and the sales force.

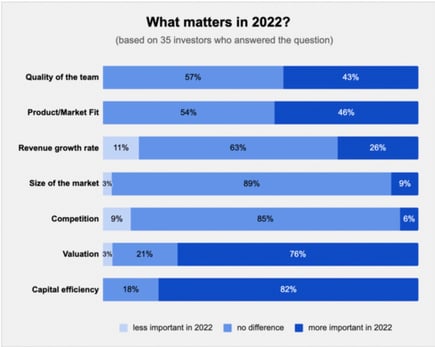

Further affirming the value of these factors are results of a poll conducted on 35 investors. This found the capital efficiency and valuation to be around 80% more important in 2022 than 2021.

Top 11 tips to raise Series A funds in a ‘funding winter’

To secure funding that will give your business at least 18 months’ runway, Wolter Rebergen, Commercial Director at Younium, and Armand had the following suggestions:

- Talk to enough investors: Attend networking events and build a network, if possible even before you incorporate your business. Also speak to fellow, competing entrepreneurs to understand market pain points and current trends. This is key to building long-term business relationships that will give you a foot in the door when the time comes to raise funds.

- Ensure your business exists in a sizable enough market: To understand your market size, multiply the number of companies in the market with your business’ average revenue per customer (ARPA), then divide it by the expected penetration. And remember that apart from the total size of the market, what also matters are the different customer profiles.

- Offer in-depth competition overview: Showcase to the VCs that you understand your competition. You should know who else is active in the marketplace and how your offerings are different from theirs.

- Establish a good product market fit: What niche does your product fit into? Once you have an answer to this, it becomes easier to grow in that space and then move to other niches. This is also a good time to showcase vision, commercial traction, and the reason why customers tend to select your brand. Be sure to also add a slide on where you come from (aka your pedigree and how it led you to this solution).

- Ready your Ideal Customer Profile (ICP): What is the ideal customer profile? What makes them tick? What are their core problem areas? Once your ICP is solidified, it becomes easier to determine your go-to-market strategy, product roadmap, and pitch strategies.

- Share your go-to-market and growth/scaling strategy: Use trackable and quantifiable milestones to explain how you intend to reach each target customer and achieve competitive advantage. For example, within a certain timeframe (W), your business will attain a certain metric (X) And after that, you will grow to another metric (Y) because of (Z) reasons.

- Do not measure metrics ONLY for investors’ sake: Start measuring your business subscription metrics as soon as your business is set-up. And use it as a mirror for your business; not just as a tool to land VC’s interest. Metrics help understand what aspects of your business are performing well and what needs attention.

Also, keep a log of how subscription metrics are built and reported so that you may create a consistent image of the business performance. All this long-term data will help you build a company that investors will queue up to get some equity in. - Ensure that data is believable: Always question your data. For instance, if you find the capital efficiency of your SaaS business growing by 2x in 3 months, check if that is possible at all (spoiler: it's usually not). And if the data is wrong, try to find out what errors led to this faulty insight.

Unrealistic data signifies that the B2B SaaS business is not serious about its future. Hence, try to extract honest insights that paint a realistic picture of your business. - Communicate regularly and openly with your investors: VCs want to invest in good businesses. And as a growth-oriented business, you want money from them. So instead of considering the VCs as the ‘others’ or ‘outsiders’, look for ways to transparently work with them as partners to improve your business’ future.

- Be confident of data sources: Have a system in place that integrates seamlessly with different sources of truth and complies with data rules, to offer a high-quality, single view of the business. Also, repeat the tracking and calculations over time so that you have enough historical data that can be harnessed to improve the business.

- Automate subscription management: We have listed this at the very end, but it is possibly the most important step for B2B SaaS companies to execute. By automating subscription operations, you can avoid revenue leakage, which in turn improves net retention. And as this metric improves, your valuation also rises, which helps position your business as a better candidate for funding.

Bonus: Are you tracking subscription data yet?

Armand Naessens (Newion), said (in a recent webinar) that the top KPIs they study in SaaS companies today are growth and churn.

VCs also care deeply about the sales and marketing funnel efficiency. If the funnel rollover data is low, they can tell that maybe something is wrong with your go-to-market strategy or product. These metrics along with customer acquisition cost (CAC) gives VCs a holistic view of your organization.

On that note, here is a round-up of the most important subscription KPIs and metrics for SaaS companies to be mindful of:

- Monthly Recurring Revenue (MRR): This is total monthly revenue that your business is predicted to achieve from the active subscriptions.

- Annual Recurring Revenue (ARR): This is total annual revenue that your business is predicted to achieve from the active subscriptions.

- Annual Contract Value (ACV): This is the annual revenue value of the contracts signed minus all temporary agreements, such as exclusive 3-month discounts or ramp-up revenue. Thus, an ACV offers-up a better outlook of the actual signed value.

- Customer Lifetime Value (CLTV): CLTV is calculated by multiplying the average time a customer remains a patron of your business by the average revenue per customer.

- Gross Margin: Gross margin is the difference between revenue and the cost of goods sold (COGS).

- Cash Flow and Cash Burn-Rate: How much money is going in and out of the business can be represented by cash flow. Meanwhile, the burn rate measures the negative cash flow.

- EBITDA: This is an acronym for ‘earnings before interest, taxes, depreciation, and amortization’ . And it signifies the core corporate profitability of the business operations.

- Customer Churn: Churn is a percentage of the customers who have unsubscribed from your solution within a time period.

- Customer Acquisition Cost (CAC): This metric is calculated by dividing the total cost of marketing and sales to bring in a customer by the number of customers in a certain period.

- SaaS Magic Number: This compares the CAC to the increase in sales from the last 3 months versus the 3 months before. And it shows how efficient your sales and marketing engine is. This magic number is also key to helping investors decide if it's a good time to invest in the company or not.

- North-star metric: This subscription metric helps predict the company’s long-term and sustainable success by delivering revenue growth, showing customer value, and measuring progress. It is decided by the company itself and acts as 'the dot on your horizon', aka a goal that you are headed towards.

Using Excel workbooks to keep “track” of these insights and data means you need to be prepared for human errors to creep in. Especially as your business grows in size, uploading, handling, and processing all this data can get complex and overwhelming.

For easy access to clean and high-quality data, it is essential to invest in a subscription management software as soon as possible.

In fact, once you reach an ARR of €1 million, or over 100 customer contracts, the plugged revenue leakage alone will more than pay for the subscription management solution.

Final word

Never forget that investors make money on investments, so they have no incentive to stop investing, ever. Good VCs are not slowing down because they know that some of the best returns come from investments made during a recession.

So, there are billions of Euros in investment funds in the EU zone, just waiting to be allocated.

Younium to help your business compete better in a funding “winter” with error-free data and up-to-date charts and reports.We make the process of due diligence seamless, thus significantly improving the chances of securing better funding. In addition, Younium keeps burn rates lower by automating billing, subscription changes (upsell/downsell), and revenue recognition amongst many more subscription management features.

To get under the hood, and better understand our many subscription management features: Watch our on-demand webinar 👇

-png.png)