What is Subscription Billing? A Guide for SaaS Businesses

What is subscription billing? What are the different types of subscription billing models? Find the answers to all your questions on the topic in this post.

This post was last updated on February 11, 2025.

Jump to read

What Is Subscription Billing?

Benefits of Subscription Billing

Challenges of Subscription Billing

Different Types of Subscription Billing Models

What To Look For in Subscription Billing Software

Building Versus Purchasing Subscription Billing Software

Best Practices to Adopt a Subscription Billing Model

FAQs

Find a Reliable Subscription Billing Software Solution

Subscription billing is a pricing model that’s grown in popularity over recent years. This is partly due to the rise of subscription-based businesses in recent years.

The global B2B SaaS market size was 327.74 billion in 2023 and is expected to reach 1088.15 billion by 2030.

Clearly, the market is poised to grow substantially and so will the adoption of the subscription billing model.

So what is subscription billing and how does it work?

We’ll answer all your questions in this detailed guide.

In this post, you’ll learn:

- What is subscription billing?

- What are its various types?

- How to choose a subscription billing solution

- And more!

Let’s get started.

What Is Subscription Billing?

Subscription billing involves collecting recurring payments from customers automatically at set intervals.

With this model, you require your subscribers to sign up for these automated charges. They also select their convenient intervals from the options you provide, e.g. annually, monthly, semi-annually, etc.

This model can be used for all types of services and products from B2B and B2C businesses.

For all these functions to run smoothly, you need a suitable subscription billing solution.

This solution should:

- Have billing cycles for each plan

- Allow you to set pricing models for each service provided

- Provide different payment options to subscribers

- Have a reporting system for subscription and billing information

There are different subscription billing models and software. The billing model and ultimately, the billing software solution you select depends on your business type and setup.

Before we discuss the important features of subscription billing software, let’s first understand the different models available.

Explore The Best Subscription Billing Platforms for 2025 and where do they fit for your business.

Benefits of Subscription Billing

Subscription billing offers many benefits for both businesses and customers. Let’s discuss some of the most important ones in this section.

1. Creates a Steady Revenue Stream

Subscription billing involves businesses charging a fixed amount periodically from each customer. Depending on your existing customers and the plans they’re on, you can easily predict how much revenue you’ll get in a period.

This ensures a steady revenue stream, which is crucial for new businesses as it helps maintain sufficient working capital and helps them manage their finances better.

The result?

Your business will not face unexpected cash flow challenges because of unpredictable or variable revenue from one period to the next.

2. Attracts More Customers

Businesses that offer subscription billing make it less risky for customers to try their products or services. Instead of paying a high one-time fee, customers can opt for a monthly plan and see if the product works for them.

For instance, instead of paying $240 for an annual fee, it’s much less risky to pay $20 and try out a software solution for a month.

If a customer doesn’t like your platform, they can leave after a month, without any regret about spending too much money on something they didn’t like.

You’d argue that that’s what free trials are for and you’re right. However, most companies offer free trials for short periods of time, such as a week or two.

That’s often not enough time to accurately assess a platform’s effectiveness. This is especially true for sophisticated B2B SaaS solutions that take time to understand.

It also takes some time for many such platforms to deliver tangible results, so the free trial may not be enough to evaluate a platform’s effectiveness.

3. Reduces Customer Acquisition Costs

Subscription billing allows B2B SaaS businesses to acquire new customers and lock them in for a specific period. This reduces the burden of acquiring new customers every month, only to lose them at the end of the month.

For most subscription businesses, clients stay for longer periods of time, depending on their subscription plan. When you have a decent number of clients locked in on long-term subscriptions, you don’t need to spend a lot monthly on customer acquisition.

While customer acquisition is still important for B2B SaaS businesses, there’s a greater focus on customer retention.

This makes the subscription revenue model more cost-effective, as you only need to deliver great service and have a great product to retain customers. Customer acquisition, on the other hand, is more expensive, requiring a lot of marketing investment.

4. Is Convenient for Customers

One of the biggest benefits of subscription billing is that it makes payments simple and hassle-free for customers.

Once you finalize the payment terms and schedule, everything will run smoothly and will not require much manual effort. This is especially true if you use a good subscription management platform.

Good subscription management platforms like Younium automate invoicing and recurring billing, making things convenient for both you and your customers.

It also makes it easy for you to track payments from various customers and check their current status, as shown below.

![]()

Image via Younium

5. Boosts Customer Retention

There are several ways in which subscription billing helps boost customer retention. Let’s discuss some of them.

- Using a subscription billing model, you can get customers to opt for long-term plans, ensuring they stay on for at least a specific period of time.

- Once a customer subscribes to a plan, you can set up auto-renewal of subscription, wherein they will continue being a customer unless they cancel their subscription.

- Subscription billing is convenient and, often, more cost-effective than traditional billing for customers. This provides enough incentive for customers to continue with their subscription unless they have a good reason to churn.

Overall, B2B businesses with a subscription billing model tend to retain customers longer than those that use traditional billing.

6. Improves Forecasting and Planning

Subscription billing makes it easier for businesses to predict their future revenue. Since customers are charged on a recurring basis, you can estimate how much money will come in during a given period.

This can help with budgeting, financial planning, and making informed business decisions. Plus, businesses that use a subscription billing model can benefit from financial predictability. They can plan for growth, manage risks, and make strategic decisions with confidence.

When you have a predictable view of your expected revenue, you can plan staffing, marketing budgets, and operational expenses accordingly. This way, you can scale without the fear of managing cash flow disruptions.

Challenges of Subscription Billing

While subscription billing offers many benefits, it also has some drawbacks. Let’s discuss the important ones in this section.

1. Complex Billing and Invoicing

Unlike B2C SaaS businesses that offer fixed plans, B2B SaaS businesses offer a lot more flexibility to their customers.

For each big account, pricing and payment terms are negotiated and finalized. This means that different customers may have completely different, customized plans and payment schedules.

In such a dynamic environment, accurately billing each customer according to their plan can be challenging. Many billing issues may arise due to this, causing delays in payments or customer dissatisfaction.

However, using a good recurring billing platform like Younium can help you overcome these challenges and automate SaaS billing and invoicing, while maintaining 100% accuracy.

2. Billing Issues with International Expansion

If your B2B SaaS business serves clients globally, one of the biggest challenges that you will face is complying with the tax laws of each country.

Also, you would be expected to allow transactions in different currencies for different clients.

Handling these nuances manually is a nightmare and not recommended.

Even if you use a subscription management platform, ensure that it makes international transactions simpler by auto-calculating sales taxes and maintaining compliance with local regulations.

Younium, for instance, supports global invoicing and payments and streamlining financial processes for your business.

3. Managing Customer Churn

While the subscription model offers convenience to customers to try a platform without a long-term commitment, it also has a downside—it’s just as easy to cancel a subscription.

If a customer doesn’t like your product or service and wants to end their subscription, it’s much easier than ending a legal contract. Yes, you may charge some fees and have a cancellation policy that may prevent most people from canceling, but it’s still feasible.

Let’s say a customer paid $25 for a monthly subscription, didn’t like the platform, and just left. They lost the monthly subscription fee, but it’s not a big loss if you put it in perspective.

Traditional B2B contracts, on the other hand, are often drafted for longer terms and are much more expensive and difficult to get out of.

So, while the subscription billing model makes it easy to bring in new customers, it also makes it easy for them to churn,

However, with effective churn analysis, you can understand why people leave and take corrective measures to reduce churn.

Here are some common causes of B2B SaaS churn to give you a broad idea.

Analyze your key customer-related SaaS metrics and find out why your customers churn.

Then, take measures to reduce churn to overcome this inherent drawback of the subscription billing model.

4. Revenue Recognition and Financial Reporting

Subscription billing brings in a steady stream of recurring revenue, but recognizing and reporting it accurately can be challenging.

Unlike one-time sales, where revenue is recognized immediately, subscription revenue must be recorded over the service period.

This means your finance team must track deferred revenue, unearned revenue, and recognized revenue in a structured manner.

If not managed properly, revenue reporting errors can lead to compliance issues, especially when dealing with regulatory standards like ASC 606 or IFRS 15.

Also, misreporting subscription revenue can result in financial misstatements, and affect investor confidence and business growth.

That’s why many businesses use automated revenue recognition tools like Younium to ensure compliance and accuracy for their subscription billing process.

What are the Different Types of Subscription Billing Models?

Every business knows what works for its needs. When selecting subscription billing models, this applies as well.

Here are the billing models available for you to choose from.

Freemium

This model works by providing free services with limited features to users, with an option to upgrade to paid plans for more advanced features.

The service provider tries to prove their value through the free plan. If the customers like their product/service, they’ll upgrade to their feature-rich paid plans.

One downside to this plan is the risk of attracting subscribers whose needs are completely met by the freemium plan. Hence, there’s a need to ensure freemium plans provide limited resources to encourage users to upgrade.

Examples of companies that use this plan include Dropbox, Calendly, and MailChimp

Image via Calendly

Tiered Fixed Fee

This is the most popular model of subscription billing for most companies. Here, they offer different packages with different fixed fees. There would also be different prices for monthly and annual billing.

Each tier of the plan has different features and the customers can choose the plans that best fit their requirements.

The revenue with this kind of model is predictable and easy to track.

The downside here is the lack of flexibility in case a customer wants to pick and choose the features they want.

Examples of companies using this model include HubSpot and Drip.

Image via HubSpot

Pay-As-You-Go

It’s also known as a consumption-based model or usage-based billing.

With this subscription model, you charge clients based on their usage. These charges are made regularly similar to the other subscription models.

This model is convenient for the users as they pay only for what they use. However, one downside to this model is that it’s hard to forecast revenue.

Amazon Web Services is an example of a company that uses this model.

Image via AWS

Fixed Price

With this model, you base your billing on a single fixed-price plan for every subscriber. This is a very predictable and easy-to-track model as you collect the same amount on a recurring basis.

However, it’s rigid for both your business and your subscribers. Users may end up paying for features they don’t need.

You as the provider on the other hand are not free to explore different avenues of revenue that come with tiered pricing.

One example of companies using this model is BaseCamp. Here’s what the plan looks like.

Image via Basecamp

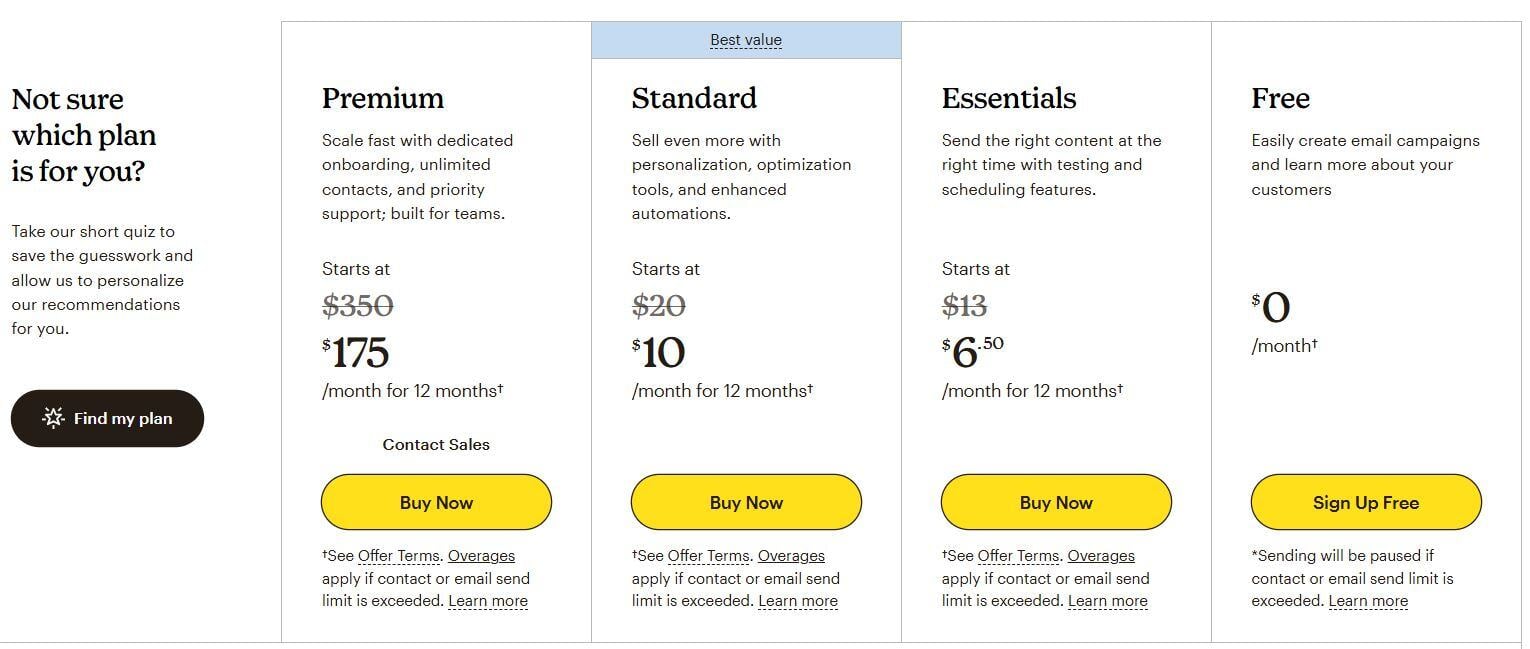

Overage

With the overage subscription model, you charge consistent, recurrent base fees for a set of resources. Then, if your user requires more resources, you charge them additional fees for add-ons or overages.

For businesses using this model, the base plan(s) and set of features, are usually enough for most of their users. Therefore, this model enables them to tap into the extra revenue from their few heavy users.

Mailchimp is an email marketing platform that uses flat rate plus overage pricing for its subscriptions. This combines tiered and usage-based pricing.

Users pay a fixed monthly fee, depending on the subscription plan they choose. However, there are monthly usage limits, beyond which overages will apply.

Here are the details of its pricing plans.

Image via Mailchimp

Custom

This subscription billing method lets your customers choose what they want. You provide your customers with features tailored to their specific needs, then base your pricing on that.

This way, the client only pays for the features they need. You on the other hand get to explore different levels of payment with each of your customers.

This method is unpredictable as well and tracking revenue is hard.

Hybrid

The hybrid subscription model lets you combine two or more billing methods.

This gives your customers more flexibility with their payment options. You can also predict your revenue to an extent, depending on the models you choose to combine.

Some examples of hybrid combinations are:

- Tiered fixed fee and overage

- Tiered fixed fee and custom

- Pay per user and tiered fixed fee

Zapier, for instance, offers a hybrid of freemium, tiered, and custom pricing, catering to diverse user needs.

Image via Zapier

Image via Zapier

Per-User Pricing

Per-user pricing is a subscription billing model where SaaS businesses are charged based on the number of users accessing the service.

This approach is popular among SaaS businesses that cater to teams, enterprises, or organizations needing multiple accounts. The more users a business adds, the higher the subscription cost.

One of the key advantages of this model is that businesses can predict costs based on the number of users they onboard, making budgeting easier. But the downside is that you may be discouraged from adding more users due to the increasing cost.

A good example of a SaaS company using this subscription billing model is Salesforce whose pricing scales per user.

Image via Salesforce

Image via Salesforce

So, you have now learned:

- What is subscription billing?

- What are the different subscription billing models?

Now, let’s move on to subscription billing software and how to identify which one is best for your business.

What To Look For in Subscription Billing Software

When choosing billing software for your SaaS B2B, there are certain important features you should look out for.

Here are some features you should consider when choosing a subscription management solution.

Recurring Billing

Subscription billing services run on the recurrent nature of the revenue collected.

Therefore, the software solution you pick needs to be dynamic enough to support this function with ease, regardless of changes made.

This includes:

- Ability to support changes in pricing

- Allowing different billing intervals such as monthly, annual, and quarterly

- Supporting both one-time and recurring billing plans

- Ability to automate invoicing and reduce invoicing errors

- Delivering invoices to customers after payment via set channels like email

- Allowing customization of invoices to fit the clients’ brands

Good subscription billing software should have these subscription management options.

Customer Management

This involves managing individual customer details from general to specific. A subscription billing software solution should be able to track customer history and store their transaction details.

This helps recognize customer preferences like:

- Their plans and features selected

- The pricing model they prefer

- Their preferred mode of payment

- Payment cycles and intervals

- Billing timelines

Here’s an example.

Image via Zoho

With this information, your business will be better equipped to provide great customer support. You’ll be able to serve your customer requests more easily.

This data also helps with marketing as you can personalize your promotions and email campaigns for your customers.

Diverse Payment Capabilities

A good subscription billing service can easily integrate with many payment platforms such as Stripe and Paypal.

This way you can offer different payment options to your customers during checkout. Typical payment options include e-invoices, credit cards, debit cards, PayPal, E-wallets, mobile payments, etc.

Here’s an example:

Image via Odoo

Image via Odoo

This is more important if it's a self-service process. You want to make the payment process for your subscribers as seamless as possible, elevating the payment experience.

That’s not all. Other capabilities your payment module should have include:

- Both online and offline payment options

- Multi-currency payments option

- A customizable checkout page

- Payment reminders for your subscribers.

- Secure payment methods and billing option

Your subscription software solution should also be able to handle failed payments or overdue payments.

What options are available when this happens? Can you send automatic reminders to your clients for delayed or due payments?

This is part of the benefits of subscription management and it helps mitigate involuntary customer churns.

Accounting Management

Your subscription system should integrate with your accounting system. Some popular accounting software your billing system should integrate with include QuickBooks, Xero, and Zoho Books.

This way, your accounting system can access information about invoices, credits, and discounts. Your business’s billing information needs to be synced with your accounting system.

Another crucial feature would be your billing system’s ability to automate the tax calculation. It should be able to do this by region, as different locations have different tax laws.

Another automated accounting function your subscription system should be able to support is the payment reconciliation function.

Billing Data and Analytics

Every subscription billing service must have reporting and analytics capabilities. Based on the magnitude of data these systems collect, from subscription to payment information, the analytics data should be detailed.

From these reports, you can access information based on key subscription metrics such as churn rates, MRR, ARR (monthly and annual recurring revenue).

Besides being detailed, the analytics also need to be accurate. The accuracy of metrics tracked helps improve your organization’s long-term projections.

For this, your system needs to integrate with analytical software like Google Analytics.

Here’s an example of what a SaaS billing analytics dashboard would look like.

Image via Zoho

Some reports you should expect your system to produce include:

- Financial analytics

- Churn reports

- A/R aging data

- Subscription metrics

Other Integrations

Other than the accounting and payment software integrations, your subscription billing system should integrate with other software as well. Here are some examples:

- Customer relationship management (CRM) software: This would help with sales management for your business.

Here’s how. Once your CRM has access to customer subscription information, then the personalization of promotions becomes easier. This helps in boosting sales.

Also, it synchronizes customer details across your platforms. You can update customer details like email address, contacts, etc. on the CRM platform from your billing platform.

- Self-service portals: This enables your customers to track their subscription and billing information online. This way, you won’t need to send invoices to your customers. It also makes payments easy for customers and allows them to easily manage their subscriptions.

Customization

How much can your subscription billing software change to fit your business? The more customization options you can get the better.

These customizations could range from changing your pricing and billing cycles to changing the appearance of your invoices.

Your subscription billing software should let you create branded invoices that align with your company’s identity. This can include adding logos, custom fonts, and personalized messages.

Take a look at an example of what a customizable invoice template looks like on Invoicera with custom color and logo.

Image via Invoicera

Also, you should be able to configure notifications and reminders on your subscription billing platform based on your needs.

For instance, you can have custom email templates for payment confirmations, failed payments, or upcoming renewals. The more control you have, the better your subscription management will be.

Fraud Prevention and Security

Subscription billing systems handle sensitive customer data, including payment details. That makes security a top priority. Your software should have strong fraud detection and prevention measures in place.

Look for important features like encryption, tokenization, and PCI-DSS compliance. These functionalities ensure that customer information stays safe from hackers and breaches.

To add to that, opt for a subscription billing software that supports multi-factor authentication (MFA). This can help add an extra layer of information security when users access their accounts and prevent unauthorized activity.

Scalability and Flexibility

Your subscription billing software should be able to grow with your business. As you gain more customers, your billing system should be able to handle increased transaction volumes without slowing down.

Consider a subscription billing platform that supports unlimited subscriptions, multiple pricing tiers, and complex billing models.

Flexibility is another key factor. You may need to introduce new plans, offer custom pricing, or create promotional discounts. A good subscription billing system should allow you to tweak these settings without requiring extensive coding.

Additionally, consider global scalability. If you plan to expand internationally, your software should support multi-currency payments and localized tax calculations.

Customer Engagement Features

Subscription billing platforms should do more than just payment processing. It should help you engage with your customers at every stage of their journey to improve renewal.

Features that support customer engagement can help enhance retention and reduce churn rate. Dunning management features like automatic retry attempts, payment reminders, and personalized follow-up emails are some features to look out for.

Also, consider subscription billing systems that let you offer discounts or limited-time promotions directly through the platform.

This will make it easy to not miss customer renewals and keep customers engaged over the long term.

Building Versus Purchasing Subscription Billing Software

Building a recurring billing subscription software solution may seem good, but it’s always easier to buy.

Here’s why.

It Will Need Constant Additions and Upgrades

As your business grows, you outgrow your current systems and your needs change, and so should your subscription billing system. You’ll have to make the following changes to your system as your business grows:

- Accommodate additional subscriptions

- Add more payment methods

- Change customer billing cycles

- Fulfil customer requests for upselling and downselling

- Pricing changes on plans

Building Software is Time Consuming

Building a subscription billing system, especially for startups, is a long and complex process. Furthermore, your testing phase might take too much time before you could use the system.

This affects both your business’s scalability and agility.

Also, due to the constant upgrades, you’ll waste a lot of time maintaining your subscription billing system.

Building Costs a Lot More Than Buying

Building a subscription software would require a lot of capital. Think about all the procedures involved and how much they’d cost.

You’d have to pay for development, debugging, testing, deployment, backups as well as ongoing maintenance costs.

And in the end, the application may not be half as good as the one you’d have bought and paid way less for.

Security Risks

By building a subscription billing system, you take the information security risks yourself.

This means that you’ll have to keep upgrading your firewalls and other security measures to prevent outside intrusions. Also, you’d have to keep up with the security regulations by different security bodies.

The subscription billing systems available in the market come equipped with these capabilities. They help you stay compliant with the required regulations like being PCI-compliant to accept card payments.

Best Practices to Adopt a Subscription Billing Model

Here are some best practices you should follow when implementing a subscription billing model for your B2B business.

Choose the Right Pricing Model

We’ve already discussed the various pricing models B2B SaaS businesses use. Consider your type of business and target customers to choose the one that works best for you.

If you want to offer your customers more flexibility, you can consider using a hybrid of two pricing models.

However, offer only as much flexibility as you can realistically manage the subscriptions. It sounds good to offer ten different plans or pricing options to customers, but it will be a nightmare for your backend team to manage that many types of subscriptions.

So, consider the pros and cons of each subscription billing model and then choose wisely.

Irrespective of which pricing model you choose, ensure complete transparency. Transparent and flexible pricing improves customer experience.

Use a Good Subscription Billing Platform

Subscription billing offers a lot of conveniences and benefits, but it’s not a model that is easy to manage. At least, not with the right tools.

You need a good end-to-end subscription billing and management platform to streamline the various processes. Such platforms automate invoicing, billing, and other complex processes, streamlining financial workflow.

Younium’s subscription billing platform is designed for handling complex B2B SaaS scenarios. It will take care of your subscription billing processes while you focus on enhancing customer experience and providing more value.

Regularly Analyze and Optimize Your Performance

Track your subscription metrics to regularly monitor business performance and optimize your strategy.

Again, most subscription management platforms will allow you to track key metrics. Opt for one that provides detailed insights and reporting.

Check out this video to learn more about the subscription metrics you can track using Younium.

@SaaS Metrics and KPIs in Younium

Ensure Seamless Payment Processing

A smooth payment experience would help you retain customers in a subscription billing model. Any friction in the payment process—like failed transactions, confusing invoices, or limited payment options—can frustrate users and lead to churn.

To prevent this, integrate multiple payment methods and gateways, and ensure your billing system can handle recurring payments without issues.

Also make it easy for customers to pay in their preferred way. Your subscription billing model should accommodate customers' preferences, whether they want to pay via credit cards, digital wallets, or direct bank transfers.

Accepting different currencies is also important if you have international customers.

Make Cancellations and Downgrades Easy

No company wants to lose customers, but making cancellations difficult will only harm your brand reputation.

If users find it hard to cancel or downgrade, they may turn to social media or review sites to share their frustration. Instead of forcing them to jump through hoops, provide a hassle-free way to adjust their subscription when needed.

Make it easy for customers to pause their subscription or downgrade to a lower plan. You can also use cancellation surveys to understand why customers are leaving.

Keep the survey short and easy to complete, offering multiple-choice options for common reasons. This data will help you identify SaaS trends and improve your offerings to retain more subscribers.

Offer Self-Service Subscription Management

With a self-service portal, customers can upgrade, downgrade, pause, or cancel their plans without needing to contact support.

This way, you can improve and personalize customer experience and reduce strain on your customer service team. Customers should be able to access their accounts and make changes.

Also, consider offering proactive support features within your subscription billing system. This may include a well-documented knowledge base and an accessible support team to offer assistance in cases of payment failures or issues.

Live chat, chatbots, and detailed FAQs can answer common billing questions before they become a frustration point.

Subscription Billing Metrics and KPIs

Just like any other business model, you need to track specific subscription metrics and key performance indicators (KPIs) to see what's working, what's not, and where you can improve your services.

Tracking these key metrics can help you make informed decisions, increase revenue, and improve customer retention. Below are the most important SaaS metrics to track:

1. Customer Churn Rate

Churn rate tells you how many subscribers are canceling their subscriptions within a given period. It's an important metric to pay attention to because losing customers directly impacts your recurring revenue.

A high churn rate can signal problems with your product, pricing, or customer service.

How to calculate churn rate:

Churn rate = (Number of canceled subscriptions / Total number of subscriptions at the beginning of the period) * 100

Ways to reduce churn:

- Offer incentives or discounts for long-term commitments.

- Provide flexible subscription options.

- Gather and act on customer feedback to address pain points and improve customer satisfaction.

2. Customer Lifetime Value (CLTV)

CLTV represents the total SaaS revenue you can expect from a single customer over their entire relationship with your business. Knowing your CLTV helps you understand the long-term value of acquiring a customer and guides your marketing and sales efforts.

How to calculate CLTV:

CLTV = (Average revenue per account x Average customer lifespan) - Customer acquisition cost

Strategies to increase CLTV:

- Upsell or cross-sell additional services.

- Enhance the customer experience to increase retention.

- Offer higher-tier pricing plans with added value.

3. Average Monthly Recurring Revenue (MRR)

MRR is the predictable and consistent revenue generated from active subscriptions each month. It gives a clear picture of your financial stability and revenue growth and also helps in forecasting revenue.

How to calculate Average MRR:

Average MRR = Number of subscribers × monthly subscription price

Ways to increase Average MRR:

- Introduce add-ons or premium features.

- Attract higher-value subscribers.

- Offer flexible pricing tiers to appeal to different customer segments.

4. Average Revenue Per Account (ARPA)

ARPU measures how much revenue a business generates per customer within a given timeframe. It helps you understand the value of your customer base and identify opportunities for increasing revenue.

How to calculate ARPA:

ARPA = Total revenue in a given period / Number of subscribers in that period.

Ways to improve ARPA:

- Offer perks to encourage customers to upgrade to higher-tier plans.

- Provide additional services or features for a fee.

- Test different pricing models to improve revenue growth.

5. Customer Acquisition Cost (CAC)

CAC is the total cost of acquiring a new customer, including marketing, sales, and promotional expenses. You need to keep CAC lower than your CLTV for a profitable business.

How to calculate CAC:

CAC = Total marketing and sales costs / Number of new customers acquired in a given period.

Ways to lower CAC:

- Optimize your marketing campaigns to reach high-intent audiences.

- Implement referral programs to acquire customers at a lower cost.

- Leverage automation to streamline customer acquisition efforts.

These subscription metrics are interconnected. For example, a high churn rate will negatively impact your MRR and CLTV.

Likewise, a high CAC might require you to increase ARPU to maintain profitability. By tracking and analyzing these metrics, you can gain a holistic view of your subscription billing business's performance.

FAQs

1. What exactly is subscription billing?Subscription billing is a recurring revenue model where customers pay a recurring fee to access a product or service.

It typically works this way. First, the customer signs up for a subscription and provides their payment information, often credit and debit cards, or any payment gateways provided.

The SaaS company then sets up a recurring billing schedule based on the chosen subscription billing frequency. This could be monthly, quarterly, or annually. The system automatically bills the customer at the agreed-upon intervals or subscription lifecycle.

2. Are there any challenges associated with subscription billing?Yes. Though subscription billing comes with many benefits such as ensuring recurring revenue, businesses also encounter several challenges, such as:

- One major issue is payment failures. Recurring transactions depend on customers having valid payment methods. So issues like expired cards, insufficient funds, or bank declines can disrupt the billing cycle.

- Another challenge is pricing strategy. Since SaaS companies must balance affordability and profitability. They often test different pricing models, like tiered or usage-based pricing, to see what works best.

- Scaling subscription billing can also be complex. As your business grows, the volume of transactions also increases. You must be able to handle this increased load without performance issues.

- Customer churn is also a major issue associated with subscription billing. Customers might cancel their subscriptions for various reasons. This could be due to dissatisfaction with the service, better alternatives, or budget changes.

If you operate a Software as a Service (SaaS) business, you can choose from several common subscription billing models that match different customer needs, including:

- Flat-rate pricing – A single price for full access to the service

- Usage-based pricing – Charges depend on customer usage levels

- Tiered pricing – Different plans based on features, usage, or users

- Per-user pricing – Customers pay based on the number of active users

- Hybrid pricing – A combination of different models, such as a base fee plus usage charges

- Fremium model – Offer limited features or services for free

- Custom pricing – Adapting or tailoring the pricing to customers’ specific needs or demands

Each of these models can affect customer lifetime value so go with a model that aligns with your service and customer expectations.

4. How do SaaS businesses handle sales tax for subscription billing?Unlike one-time purchases, subscription billing requires businesses to track taxes over time and apply the correct rates to recurring charges which makes tax calculations more complex.

To handle this, SaaS businesses often use automated tax software that integrates with their subscription billing systems. These tools calculate taxes based on customer location, apply the correct tax rates, and generate reports for tax filing.

5. What should I look for in a subscription billing system?

To select a good subscription billing platform for your business, here are some key features you should look for:

- Recurring billing

- Customer management

- Diverse payment capabilities

- Accounting management

- Billing data analytics

- Integrations

- Customization options

- Fraud prevention features

- Customer engagement features

- Scalability and flexibility

Find a Reliable Subscription Billing Software Solution

Now that your question, “what is subscription billing?” is answered, it’s time to shape your subscription business model. This post has already outlined all you need to know about subscription billing models and how they work.

You need to keep track of your B2B business’s recurring revenue. For this, your subscription management, financial management, and research analytics need to be reliable for optimal performance.

What better way to achieve this than to find the best subscription billing software and pricing plans that suit your business?

Younium was named by HubSpot as one of the 12 best Subscription Billing Software solutions, highlighting the significant market demand for this type of product. And it is listed as top solution in recurring billing by leading SaaS digital agency Attrock.

What is it that you’re waiting for?

Switch to a subscription billing model and use a good system to manage it. Get your Younium free demo now to improve your SaaS business’s subscription billing process.

All the best!