What is a Good Churn Rate for SaaS Companies? Benchmarks

What is a good B2B SaaS churn rate and how can you reduce churn for your SaaS business? Read this comprehensive guide to find all the answers you seek.

.png)

This post was last updated on October 24, 2024.

Jump to read

What are SaaS Churn Rates?

Why is SaaS Churn Rate Important?

What Causes Churn in B2B SaaS Companies?

Calculating Your SaaS Churn Rates

SaaS Churn Benchmarks

How SaaS Churn Rates Vary

Why is it Hard to Find Accurate Churn Rate Benchmarks?

7 Strategies to Reduce Your SaaS Churn Rate

FAQs

Lower Your Churn and Increase Retention

Churns can be a major problem for any SaaS company. However, you cannot completely prevent SaaS churns. Some clients will always leave regardless.

This raises the question — what are the acceptable SaaS churn rates for companies?

There’s no easy way to respond to this question as SaaS churn rates are calculated differently, and they impact companies differently.

The bottom line for any SaaS company is to be able to calculate their subscription metrics and gauge them against industry benchmarks. This way, they’ll know if they’re within the “good-churn” spectrum.

This post discusses these calculations as well as some common industry benchmarks every SaaS business should consider.

Let’s dig deeper.

What are SaaS Churn Rates?

The SaaS churn rate is a figure that shows you the percentage of customers who are canceling their subscriptions within the set period.

Most SaaS companies depend on recurring revenue from their users. Therefore, tracking churn metrics is vital as a higher churn rate could mean depleting revenues.

SaaS churn rates show:

- A company’s performance

- How many customers the company has retained

- How much it has expanded its customer base

- If a company is growing or not

Calculating SaaS churn rates doesn’t merely stop at determining the number of canceled subscriptions. There are more nuanced details to factor in such as revenue, upgrades, downgrades, expired renewals, etc.

We will discuss the specifics of how you can calculate SaaS churn rates in a later section. But first, let’s cover some basics.

Why is SaaS Churn Rate Important?

Calculating your SaaS churn rate helps you assess the overall health of your business. If you’re losing more customers than you’re gaining, there’s a big problem that you need to solve.

Here are some reasons why it’s important to regularly track your SaaS churn rate.

- It shows you your current market position and standing among competitors. Customers often leave a company because competitors are offering better products and services, probably at better prices. If this is the case, tracking your SaaS churn rate can help identify the issue.

- A high SaaS churn rate could also indicate that there’s something lacking in your products or services. If most of your customers are leaving after trying your product for a short period, then there’s likely a product issue that you need to address.

- Tracking your SaaS churn rate also helps you assess customer retention and loyalty. A low churn rate signifies high brand loyalty and vice-versa. If your SaaS churn rate is high, despite your product being best-in-class, consider using customer retention strategies to reduce it.

- Your SaaS churn rate is a key parameter investors will look at when evaluating your business for investment purposes. A company with an unusually high SaaS churn rate will struggle to find investors and lenders. That’s why it’s important to keep it at par with industry standards.

- Lastly, tracking your SaaS churn rate can lead to product innovation and improvements. A high rate helps you identify possible product issues and fix them. In the long run, this is beneficial for you as you will end up with a great product at the end of it all.

These are just some of the many reasons why you should track your SaaS churn rate.

Now, let’s understand some reasons why customers churn, in the next section.

What Causes Churn in B2B SaaS Companies?

There are many causes of churn for B2B SaaS companies. Let’s discuss some of the most common ones.

1. Payment Issues

Payment failure is not a big issue for B2B SaaS companies as most B2B clients don’t use credit cards for automatic payments.

However, some subscription billing issues could delay payments and annoy clients, causing churn.

These could be issues related to subscription revenue recognition and incorrect invoicing.

Using a good B2B subscription management platform like Younium can help avoid these issues. It can automatically create accurate invoices and send payment reminders to clients, to avoid any delays or payment-related issues.

It also gives you an at-a-glance overview of the payment status for various clients, as shown below.

Image via Younium

Check out Younium’s other billing-related features by booking a demo.

2. Poor User-Product Fit

One of the most common reasons for a high SaaS churn rate is that your company is attracting the wrong customers.

It might seem counterintuitive, but attracting a lot of customers, who may or may not be a good fit for your company is not a great idea. Yes, it will give you a revenue boost in the short term, but you will get a high SaaS churn rate and most of your customers will leave.

This is because they’re not the intended users of your product.

For a B2B SaaS company, it’s a better strategy to focus on attracting the right clients, instead of casting a wide net. If people don’t find your SaaS product useful, they’ll churn, which is a waste of money you spent on customer acquisition.

3. Missing Features

If you attract the right customers, who are the intended target customers for your product, you may still witness churn if your product lacks certain features.

This is especially true if your competitors offer more features, at a competitive price. Customers will flock to the company that offers maximum features for the best price.

As such, keeping track of your competitors and regularly adding new features to your SaaS product can help reduce your SaaS churn rate.

4. Bad User Experience

Even if you offer the best features at the lowest price, customer churn can happen because of poor user experience.

This could be because of a poor user interface that makes using your SaaS product difficult for customers. If your customers frequently face difficulties using your product, they’ll likely switch to a competitor.

5. Ineffective Onboarding

Onboarding is an important step in ensuring a great user experience for your customers.

At this step, B2B SaaS companies introduce a new customer to their product and interface and provide guides and resources they need to use it optimally.

If you fail to provide the required onboarding support, then new customers may struggle to use your product. This may result in poor user experience, which can lead to a high SaaS churn rate.

Also, effective onboarding is a great way to make a good first impression on your customers. If you provide a poor onboarding experience, they’ll develop a negative impression, which will eventually lead to churn.

6. Poor Customer Support

Providing great customer support is crucial for customer retention for B2B SaaS companies.

Even if you offer the best product in the market, it won’t make much difference if your customer support is slow, non-responsive, or ineffective.

B2B customers expect quick and effective problem resolution because delays can cause significant business losses. A business can’t wait an entire weekend to get a technical issue resolved on the next working day.

Even a single instance of ineffective customer support can cause customer churn and increase your SaaS churn rate.

That’s why it’s important for B2B SaaS companies like yours to offer 24/7 customer support and quick issue resolution.

Calculating Your SaaS Churn Rates

SaaS companies focus on these churn metrics to determine their performance.

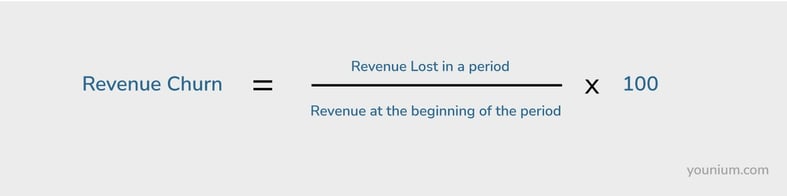

Revenue Churn

This refers to the revenue lost over a given period as a result of canceled subscriptions.

Here’s how you calculate revenue churn: Take the total revenue lost in a period and divide that by total revenue at the beginning of the period. Multiply that by 100 and you have your rate.

But revenue churn is more than just canceled subscriptions. It’s also about upsells, upgrades, add-ons, downgrades, payment failures, and other revenue losses.

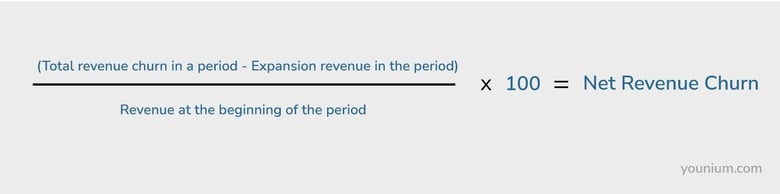

This is why, for a more nuanced result, you can calculate the net revenue churn.

Net revenue churn is calculated by subtracting expansion revenue in a period from the total revenue churn in that period. The result is then divided by total revenue at the beginning of that period and multiplied by 100 to get the percentage.

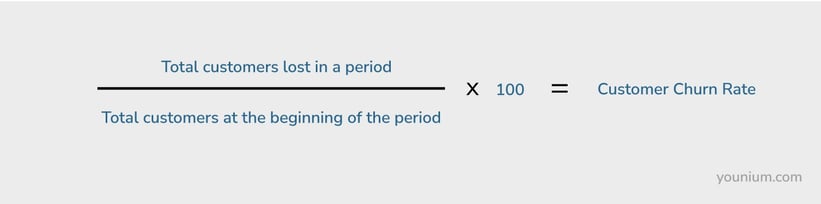

Customer Churn Rate

Also referred to as logo churn rate, this metric tracks how many customers cancel or fail to renew their subscriptions.

Here, you take the total number of customers churning in a period and divide it by the total number of customers at the beginning of the period.

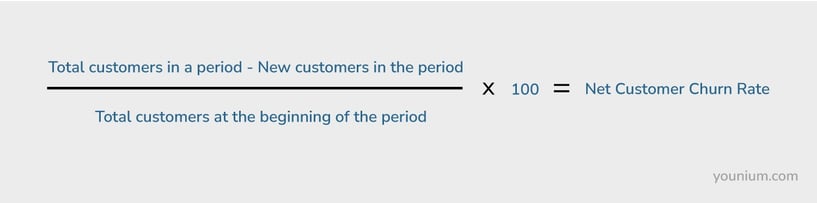

Net customer churn rate, however, is more detailed as it factors in new customers gained along the way.

To calculate it you take the total number of customers in a set period and subtract new customers gained. Divide the result by the total number of customers at the beginning of the period then multiply by 100.

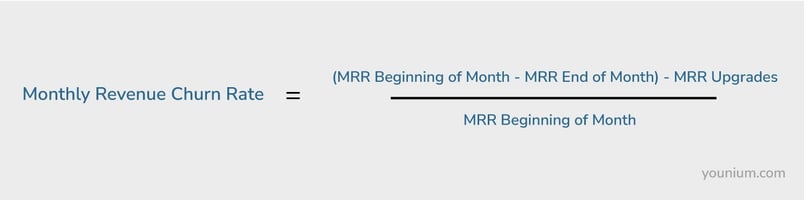

Monthly Revenue Churn

Saas churn rates can also be tracked by period to understand your short-term and long-term performance.

Monthly revenue churn is calculated by taking the total MRR churn and subtracting expanded MRR from it. The result is then divided by the total MRR at the beginning of the month and multiplied by 100.

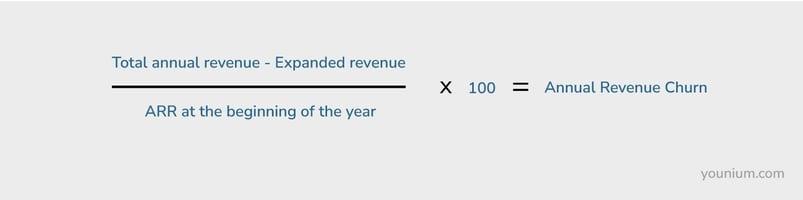

Annual Revenue Churn

This metric tracks annual subscriptions and year-to-year performance.

Here, you take the total annual revenue, then subtract expanded revenue divided by ARR at the beginning of the year. Then multiplied by 100 to get the percentage.

Let’s now take a look at the churn benchmarks your SaaS organization can reference.

SaaS Churn Benchmarks

Different companies recommend varying SaaS churn rates as acceptable. But they all depend on many other factors and there’s no one-size-fits-all policy.

A survey found a median revenue churn rate of 9% to 17% for companies with different annual revenues. The median rate for all companies was 12%

Here’s the graphical representation of these results:

Image via KeyBanc Capital Markets

The average annual customer churn rate in the same survey was 13% as below.

Image via KeyBanc Capital Markets

The survey was conducted among over 350 SaaS private companies across the US, Canada, and Europe. This shows a large enough sample space to prove the relevance of the statistics found. You can use these as benchmarks for your churn rate too.

For small SaaS companies and startups, the churn rates may be different.

How SaaS Churn Rates Vary

Here’s a closer look at how monthly churn rates vary from annual churn rates.

Monthly vs Annual Churn Rates

There’s no ideal churn rate since it depends on whether it’s calculated based on customers or revenue lost. However, a rate between 5% and 7% annually can be considered good if you’re basing your calculations on customers.

How accurate is this benchmark? More so, how achievable is this rate for large vs startup SaaS companies?

A 5% to 7% annual churn rate means 0.4% to 0.6% monthly churn rate. Logically, this holds water. It means that, for instance, a company with 2000 customers would only lose 100 of them on average in a year.

However, a 5% SaaS churn rate in a month or more isn’t so good. This would translate to an annual churn rate of 46% if you factor in expansions.

It’s a high churn rate. Having that kind of loss in customers or revenue per month can only have adverse effects on your business.

But how realistic is it to achieve this supposed “ideal” churn rate?

This will depend on different variables, both internal and external. Here’s a look at them.

Your Company Size

Larger, more established SaaS companies have lower churn rates compared to their smaller counterparts.

Large companies have these advantages over their smaller counterparts.

- They have an established market with stable clients, largely enterprises. This takes both time and effort to achieve. These companies have had enough time to build their markets to this level. This reduces the churn.

- Most established SaaS companies issue longer contract-based services, such as annual contracts. With this, customers are restricted from backing out mid-way as they please. This means more stability in retention rates for a given period.

- Large companies attract large clients. These large clients are mainly financially established as well. Therefore, they’re unlikely to end their subscription due to financial constraints. Considering financial issues are a common cause of customer churn, this gives them an upper hand at customer retention.

That said, larger businesses are more likely to stay within the 5% to 7% churn rate range. It’s a lot harder for smaller businesses and startups as they’re only starting to build their brand.

Establishing loyalty with their customer base takes time. So does landing high-value enterprises. Similarly, they issue shorter subscription plans which increase the likelihood of churn.

Product Type and Market Placement

For SaaS companies, different software solutions have varying levels of churn. Depending on their usability, some software will be deemed more essential compared to others.

For instance, having a subscription billing software solution may be deemed more integral to a SaaS business than a website designing software solution.

Therefore, such integral SaaS software will have lower churn rates.

Your company’s placement in the market also matters in this sense. When starting out, you’re still trying to find the right market fit for your product. Your churn rates may be high at this point.

As your business grows, you make better marketing decisions and your churn rate begins to lower.

Voluntary Versus Involuntary Churns

Your SaaS churn rates also depend on whether or not the client intended to cancel or downgrade.

Either churn rates have different causes and can be mitigated differently.

Involuntary churn rates typically have to do with failed payments or missed deadlines for contract renewals.

Reducing involuntary churn is sometimes within a business’s control as these customers don’t necessarily want to leave you. For instance, in a situation where the contract renewal is delayed by a few days or weeks, you could still get your customer back.

Voluntary churns, on the contrary, can be due to a myriad of reasons, some of which may not be in your control.

These include:

- Financial constraints

- Poor customer experience

- Competition from other players in the industry

To prevent future churn, you could consider improving your marketing efforts by conducting market research to ensure that you’re reaching the right target audience. Also, you should channel more efforts towards improving customer experience.

This way, you’ll be well-positioned to improve your services and retain your client base.

Why is it Hard to Find Accurate Churn Rate Benchmarks?

Now, you might be wondering why it’s difficult to find the right benchmarks for churn rate. Here’s why.

- Data scarcity: There's inadequate SaaS churn rate data out there. Very few companies are willing to share their churn rate details publicly. Therefore, finding a more accurate benchmark is harder. Having exact churn data from SaaS companies would be more helpful in identifying major causes as well as overarching solutions.

- Obscuration of information: Large companies are prone to filtering the data they put out in public, especially if it’s negative. Unlike financial reports, which public companies are required to share by law, there’s no legal obligation to share churn data.

7 Strategies to Reduce Your SaaS Churn Rate

Now, let’s look at some of the key strategies to reduce the SaaS churn rate.

1. Use a Good B2B Subscription Management Tool

Lastly, using a B2B subscription management platform like Younium is a must if you want to reduce your SaaS churn rate.

These platforms simplify the complexities of subscription management and help you provide a great customer experience.

Some areas where subscription management platforms can help include:

- Accurate and automated billing and invoicing, even for complex billing scenarios.

- Efficient onboarding and initial setup owing to integrations with other tools.

- Better subscription management by enabling plan changes and modifications to suit customers’ needs.

- Numerous billing and payment options that allow B2B customers to choose their own payment terms and schedules.

- Detailed analytics to understand customer preferences and improve customer retention by better meeting customers’ needs.

- Churn analysis and prediction to understand the causes of churn and identify at-risk customers.

These are just some of the many benefits of a subscription management platform.

When choosing a platform, look for these must-have subscription management platform features:

Younium offers all these and more. It is one of the best B2B subscription management platforms in the market today. It will streamline your business processes and help you provide a seamless customer experience, reducing your SaaS churn rate.

2. Optimize Your Onboarding Process

We’ve already discussed that ineffective onboarding is one of the common causes of customer churn.

The question is: how can you effectively onboard new customers to provide a great experience and improve retention?

Here are a few tips.

Make the Setting Up Process Seamless

Once a customer has subscribed to a plan and filled out the initial questionnaire, they’d want to set up their account. Make this process as easy and hassle-free as possible.

Younium, for instance, automatically sets up a client’s account based on their country and preferences. This includes information related to currency, tax rate, language, etc.

Here are some examples of automatic configurations within Younium’s subscription management system.

Image via Younium

Apart from this, it provides personalized onboarding assistance to new clients to get started quickly and start using the platform seamlessly.

Here are some other tips that you can follow.

- Provide easy integration and data import options, so that customers can connect your platform with their existing tools.

- Offer a step-by-step intuitive setup guide that anyone can follow to set up their account, customize their dashboard, and start using your product.

- Leverage in-app prompts and short tutorials to get people started quickly and have a great experience using your product.

- Create an onboarding checklist and provide a step-by-step guide to new customers for the initial setup.

HubSpot CRM, for example, offers prompts and guided tours to help new customers get acquainted with the interface. The user-friendly, intuitive interface, combined with these, allows new users to start using the platform efficiently, from the get-go.

Here’s an example of the kind of prompts it provides.

Image via Page Flows

Create a Customized Onboarding Plan

Each customer has a unique business need and reason for using your SaaS product. As such, you should understand their needs and tailor your onboarding plan accordingly.

You might think that it’s a difficult task, but it doesn’t have to be. You just need to ask for each customer’s preferences at the beginning of the onboarding process. Then, you help them set up their account to meet their specific needs.

Many B2B SaaS companies start the onboarding process with a simple questionnaire to collect customer information and preferences. This makes it easier to customize the dashboard for each client.

Clockwise, a calendar tool used by many companies uses a series of questions to customize the onboarding experience for each customer.

Here are a couple of steps in the onboarding process for Clockwise to give you an idea.

Image via Page Flows

By understanding a user’s role and goals for using the product, Clockwise helps people customize their dashboard per their needs.

If you offer a B2B SaaS product with numerous features and functionalities, you can replicate this strategy.

Also, for more complex B2B SaaS products, it’s better to have an onboarding call and provide personalized assistance to new clients.

Provide Comprehensive Learning Resources

Lastly, provide tutorials, guides, and other learning resources for new customers to learn how to use your platform like a pro. Create a comprehensive knowledge base with everything that a new user would need to get started with your product.

Ideally, your customers should not need to contact customer support for product-related queries. They should have all the information they need to use your product to meet their specific needs.

Here are some types of learning resources you should consider creating and sharing with new customers.

- A product manual explaining all features and functionalities of your SaaS product.

- Step-by-step how-to guides and interactive tutorials to teach people how to use the product interface.

- Detailed videos explaining how to perform key tasks and actions using your product.

Younium, for example, offers guides on how to use its subscription management platform, as shown below. This helps customers solve most of the common challenges themselves.

Image via Younium

Make sure you send a welcome email to new customers, as soon as they subscribe to a plan. Include the links to all these resources and your onboarding checklist in this email, to make the process easier for them.

This will help you effectively onboard new customers and reduce your SaaS churn rate.

3. Encourage Longer Subscription Plans

One quick and effective strategy to reduce your SaaS churn rate is to encourage new customers to opt for long-term subscriptions.

You can do so by providing an incentive, such as a discounted rate or any other offer that provides more value with long-term plans.

Of course, this does not necessarily mean that customers won’t churn or cancel their subscriptions if they don’t find your product useful. However, it will help improve your average SaaS churn rate and most customers would stay on for a longer period.

Here are some tips to help you use this strategy to reduce your SaaS churn rate.

- Offer multiple long-term subscriptions, and don’t limit yourself to just an annual subscription, along with a monthly subscription.

- Provide higher discounts and offers for longer subscriptions.

- Clearly disclose cancellation and refund policies to remove any hesitation customers may have regarding subscribing to long-term plans.

Longer subscriptions are also convenient for customers as they don’t need to worry about monthly or quarterly payments. Paying annually or even longer is typically more convenient for B2B customers.

As such, with a little nudge and the right offers, you can easily convince customers to get longer subscriptions. This locks them in for a long period, thus improving your average churn rate.

4. Appoint a Customer Success Team

It’s no secret that customer support can either help with customer retention or be the cause of customer churn.

Offering multiple support options and 24/7 support has become a necessity and is not optional anymore. B2B customers expect quick and effective problem resolution and may switch to competitors if they don’t get it.

However, for a B2B SaaS company, it’s the bare minimum. You need to take things a notch higher and offer dedicated customer support via customer success advisors.

According to Gainsight, 41% of North American B2B SaaS firms had a dedicated customer success team in 2023. A number that almost doubled from the 20% in 2022. Clearly, more and more B2B SaaS companies are investing in it and so should you.

A customer success team that will ensure that customers can make the most of your SaaS product and benefit from it. If your customers are successful and achieve their goals because of your SaaS product, they’ll keep using it for years.

This, of course, will help you reduce your SaaS churn rate and boost customer retention and loyalty.

Follow these tips to get started:

- Invest in a customer success team, which is separate from your customer support team.

- Hire people with the right customer-centric mindset and technical skills required to help customers use your product to its full potential.

- Train them to cater to your clients and help them succeed using your SaaS product effectively.

- Clarify their roles and responsibilities throughout the customer lifecycle, from onboarding to churn.

- Assign a dedicated customer success manager to all your top clients, but provide all clients access to your customer success team.

Investing in a customer success team can be a game changer for your company and will help reduce your SaaS churn rate.

Younium, for instance, is a great example of B2B SaaS companies that assign customer success managers to help their clients. Their experts will help you set up your account and use the platform to its full potential.

5. Keep Updating Your SaaS Product

As discussed, one of the reasons you might have a high SaaS churn rate is that your product lacks features your competitors are offering.

You can easily overcome this challenge by regularly introducing new and innovative features and updating your SaaS product.

There are two key things you should do:

- Keep an eye out for your competitors’ offerings and feature introductions. This will help you ensure your product is best-in-class and doesn’t lack any important features.

- Listen to your customers’s requests and feedback to continually improve your product and develop new features.

This doesn’t mean you shouldn’t work on product innovation proactively and only react to customer feedback or to compete with others.

In fact, you should have a dedicated product development team that works on introducing new features and functionality that make your customers’ lives easier.

Sometimes, product improvement could just mean providing a smoother user experience and not necessarily introducing new features. In either case, your customers will be happier with your product and stay loyal to your company, thus reducing your SaaS churn rate.

6. Collect Customer Feedback and Act on It

Collecting and acting on customer feedback is a universal strategy that all businesses should follow to improve customer retention. After all, the goal of any business is to keep its customers happy and encourage repeat business.

Never fall under the misconception that you’ve made a perfect SaaS product or that you offer unmatched customer service. Instead, ask your customers how you can make your product and customer service even better.

Always strive for continuous improvement in your business to stay on top and keep your customers happy.

Customer feedback can help you smooth out the kinks and deliver a truly exceptional experience.

Here are some ways to collect feedback:

- Periodically send feedback collection surveys via email.

- Always seek feedback after each customer interaction with your support team.

- Use in-app forms and surveys to collect feedback.

- Collect usage metrics to track how customers are using your product.

- Directly talk to your top customers and ask them how you could improve and make their experience better.

Here’s an example of a customer feedback collection email by Miro, a collaboration tool.

Image via Really Good Emails

The heading “Your feedback makes Miro better” shows customers that the company cares about their experience and wants to improve.

This also encourages customers to fill out the survey and help make the product better, which eventually will help them.

Once you have collected customer feedback, ensure that you implement changes that your customers requested and make the necessary improvements.

Focus on areas for improvement that most customers commented on.

For instance, if most customers face issues navigating the product’s interface, improving it should be your top priority.

7. Provide Extensive Customer Support Options

One of the key reasons for a high SaaS churn rate is poor customer support. If you’re not able to resolve customer issues effectively and promptly, they’ll likely switch to a competitor.

That’s why it’s important to provide extensive round-the-clock customer support options.

Business customers don’t want to wait for replies to their emails and typically prefer faster support options, such as phone or live chat support.

If you’re running a B2B SaaS company, you need to provide multiple support options so customers can reach out to you using their preferred channel. You should also train your support team to solve any product-related issues efficiently.

FAQs

1. What is the average churn for SaaS companiesAccording to a survey, median annual revenue churn rates vary from 9% to 17% for businesses of different sizes. The median churn rate for all industries was 12%.

However, this is based on the findings of just one survey. The actual SaaS churn rate may vary from industry to industry and business to business.

It’s better to track your SaaS churn rate regularly and try to improve it over time, instead of relying on industry benchmarks. The simple reason is that industry benchmarks for SaaS churn rates vary widely.

2. How do you calculate churn for SaaS businesses?There are four major metrics to calculate churn for your SaaS business. These include.

- Revenue churn rate: It shows the percentage of revenue your B2B SaaS company lost in a given period.

- Customer/logo churn rate: The number of customers your company lost in a given period is shown by the customer churn rate.

- Monthly revenue churn rate: It shows the percentage of revenue your B2B SaaS company lost in a month.

- Annual revenue churn rate: This measures the percentage of revenue your B2B SaaS company lost in a year.

While calculating churn, you should also consider the revenue or customers earned in a period and then calculate the net loss.

3. What is a good churn rate for a startup?Startups have higher churn rates at the beginning, ranging from 7% to 8% monthly. This is a normal churn rate for startups as they establish their product/market fit.

With time, the churn rate should get lower. A good benchmark would be 10% to 15% annually as the company grows both its product and market.

Eventually, as it establishes in the market, a 5% to 7% rate would be an even better benchmark.

However, don’t try to follow these benchmarks for the SaaS churn rate strictly. An ideal SaaS churn rate for your business may differ from that for another type of company.

4. What is a good customer retention rate?A customer retention rate of 90% is considered good for small businesses. However, you should strive for a rate greater than 100%.

5. What is acceptable churn for SaaS?An acceptable churn rate would be 10% to 15% annually for small businesses and 5% to 7% annually for larger SaaS companies. However, if your SaaS churn rate doesn’t fall in this range, there’s no need to worry. The key is to improve your churn rate over time, as your business grows.

Lower Your Churn and Increase Retention

There may not be a single good SaaS churn rate. But whatever your rates are, you can always lower them. In the end, your recurring revenue depends on your customer retention, a part of which involves reducing churn.

With larger or more established SaaS companies, the median annual revenue churn rate was around 12% according to the KBCM survey. This is an achievable rate to work towards to continue growing.

Conversely, for smaller businesses and those just starting out, a 7%-8% monthly rate may be bad but it’s common.

To monitor your churn rates, you could leverage Younium’s subscription management platform. It will give you access to your subscription analytics that will help you gather insights on how you can minimize your churn rate and scale your recurring revenue. So, get your free demo now.