11 Maxio Alternatives in 2026 for Subscription Management

Explore 11 Maxio alternatives for flexible subscription billing and revenue management that help SaaS businesses streamline financial operations.

As SaaS companies scale, billing and revenue management become more complex. Managing them manually can be a task, as manual business processes are prone to errors and make compliance difficult.

Finance tools like Maxio can help, but there are other software that could suit your business better and offer more features for value.

In 2026, many platforms can offer excellent subscription management, reporting capabilities, and even flexible pricing models.

If you’re also looking for Maxio alternatives, this post has 11 options suited for SaaS B2B teams. We’ve reviewed the core features and unique advantages of each option to help you make a confident decision.

Overview of Maxio

Maxio is a subscription billing and revenue management platform for SaaS companies. It helps finance teams handle the complexities of recurring billing, automated revenue recognition, and reporting. Key features include:

- Automated Billing: Supports subscription plans, usage-based billing, and one-time charges

- Revenue Recognition: Built-in tools for GAAP and IFRS 15 compliance for revenue recognition

- Detailed Reporting: One-click financial reports, configurable dashboards, MRR/ARR tracking, and analytics dashboards

- Integrations: Works with CRM systems, ERPs, and payment gateways like Salesforce, NetSuite, and Stripe.

- Dunning Management: Automated payment reminders to reduce churn rate

When to Consider Switching to Maxio Alternatives

Maxio offers relevant tools for financial management, but it may not be the best fit for every business model. If your company’s needs go beyond its current capabilities, it might be worth exploring alternatives. Businesses often look for other solutions in the following cases:

- Subscription-Heavy Revenue Models: If your business relies heavily on recurring revenue, complex subscription contracts, or requires flexible booking and reporting tools, Maxio may fall short.

- Detailed Financial Data and Traceability: Companies that demand robust revenue accounting, deep reporting, and audit-ready traceability may need to look for Maxio alternatives.

- Extensive Implementation Support: If you need extensive hands-on support during setup, Maxio’s onboarding process can feel slow compared to more lightweight, plug-and-play Maxio alternatives.

- International Operations: Companies that operate globally may need stronger multi-currency handling, tax compliance, and localization features that most Maxio alternatives provide.

- Integration Needs: If your existing tech stack depends on seamless integrations with other platforms for analysis and other functionalities, Maxio’s gaps can be a hindrance.

- Flexible Bookings and Reporting: Businesses that need agile booking processes, customizable reports, and deeper analytics may have to explore Maxio alternatives.

- User Experience Expectations: Teams that prioritize a modern, intuitive interface may find Maxio less user-friendly than some alternatives.

Key Factors to Consider When Choosing Alternatives to Maxio

When comparing Maxio alternatives, it’s important to focus on the subscription management features and capabilities that will significantly impact your finance operations. Here are the factors to look for:

- Flexible Subscription Billing Support: While Maxio supports a range of billing options, its configuration and scalability may not align with every business model. If your pricing strategy depends on complex or highly customized usage metrics and multi-dimensional usage tracking, you may benefit from an alternative that provides deeper flexibility and automation.

- Revenue Recognition and Compliance: For SaaS companies to manage their finances, proper revenue recognition is mandatory. The right tool should allow compliant revenue recognition so you can avoid errors and save time during audits.

- Reporting and Analytics: Look for Maxio alternatives with detailed financial and subscription analytics. Essential subscription metrics to monitor include MRR, ARR, churn, and customer lifetime value. Having the ability to create custom reports is also a huge plus.

- Integration Ecosystem: Ensure that any Maxio alternatives you choose allow seamless integration with your existing stack, whether that’s NetSuite, Salesforce, HubSpot, Stripe, or other core systems.

- Scalability and International Features: If you plan to expand globally, you’ll need features for multi-currency billing, localized invoices, and automated tax calculations.

- Ease of Use: Consider how quickly you can set up and use the tool based on your team’s technical expertise. A tool that’s intuitive and easy to adapt will save you time and reduce training costs.

Also Read:

- Best Revenue Recognition Software (Plus How to Choose the Best One)

- The Future of SaaS Pricing: Finding the Right Model for Growth

11 Best Maxio Alternatives in 2026

If Maxio is not the right fit for your business needs, there are several subscription management platforms to choose from. Here are some noteworthy alternatives you can consider:

1. Younium

Image via Younium

Younium is a subscription management and revenue recognition platform for B2B companies with complex billing scenarios. One of Younium’s biggest strengths as one of the best Maxio alternatives is its ability to handle sophisticated usage-based and hybrid billing models.

Manually tracking usage often leads to missed revenue or billing disputes. Younium eliminates this risk by automating usage imports and pricing calculations in real time based on subscription activity. This guarantees accurate, timely billing while giving customers transparent, reliable invoices.

It also supports custom logic to accommodate multiple contract types and structures. With its AI Copilot, Younium identifies subscription anomalies, provides predictive insights, and even automates recurring workflows like monthly reporting.

The platform can be deployed as a standalone tool or as part of a connected finance stack. It integrates with ERP, CRM, and payment systems so you can keep data consistent across departments.

Younium provides strategic support that goes beyond onboarding. It delivers ongoing finance advisory, helping teams scale billing operations while staying compliant and audit-ready.

Key Features:

- Real-time usage imports and pricing calculations to prevent revenue leakage

- Revenue recognition compliant with ASC 606 and IFRS 15

- Integration with ERP, CRM, and payment gateways

- Configurable custom logic for complex contracts and pricing structures

- Multi-currency and tax handling for international operations

- Financial and operational reporting dashboards

- Role-based access controls for finance and operations teams

- Automated invoicing and payment collection workflows

Pricing:

Younium provides customized SaaS pricing based on your business’s specific requirements. Reach out to its sales team for a quote.

2. ChargeOver

Image via ChargeOver

Another Maxio alternative that SaaS businesses can use for subscription billing and revenue recognition is ChargeOver. Businesses can customize billing schedules, offer flexible payment options, and create branded invoices with this tool.

ChargeOver’s real-time reporting functionality can monitor over 40 detailed SaaS metrics. As a SaaS business, these detailed insights are necessary for improving cash flow and reducing churn. The platform also integrates smoothly with over 60 tools and supports more than 50 payment gateways worldwide.

Key Features:

- Automated recurring billing and subscription management

- Customizable SaaS billing schedules and payment options

- Branded invoices and automated email reminders

- Real-time analytics with more than 40 in-depth reports

- Churn tracking and customer lifetime value insights

- Over 60 integrations and more than 50 payment gateway connections

- Built-in dunning and payment recovery automation

- Self-service customer portal for account management

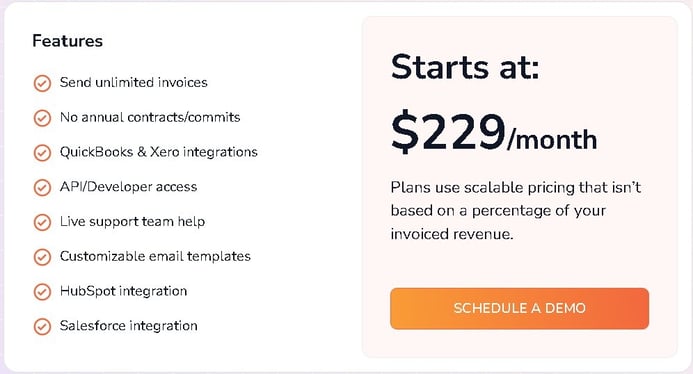

Pricing:

ChargeOver uses a scalable monthly pricing model starting at $229/month.

Image via ChargeOver

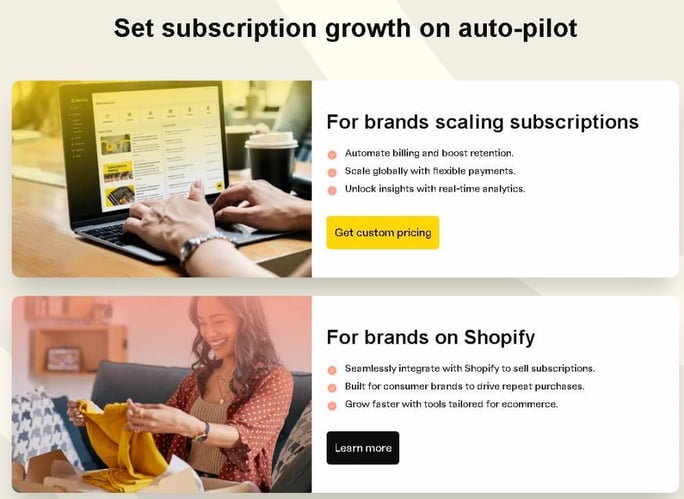

3. Recurly

Image via Recurly

Another tool on our list of Maxio alternatives for subscription management is Recurly. It allows you to create, test, and optimize subscription plans, promotions, and pricing strategies.

With payment orchestration, Recurly supports multiple gateways and payment methods to expand your global reach.

Recurly’s built-in churn analysis and management tools help recover failed payments and reduce subscriber attrition. The platform also simplifies compliance with revenue recognition standards like ASC-606 and IFRS-15.

You can also connect with CRM, ERP, and other essential business systems.

Key Features:

- Automated recurring billing and subscription management

- Subscriber lifecycle communication automation

- Multi-gateway payment orchestration and fraud protection

- Churn reduction and revenue recovery tools

- Automated revenue recognition and compliance reporting

- Customizable reporting and analytics dashboards for tracking SaaS metrics

- Pre-built and API-driven system integrations

- Enterprise-grade security and compliance framework

Pricing:

Recurly customizes its pricing based on each business’s subscription volume and specific requirements.

Image via Recurly

Also Read:

- AI in Subscription Management: What It Is and Why It Matters

- What Is Revenue Leakage (Plus How to Identify and Prevent It)

4. Billwerk+

Image via Billwerk+

Billwerk+, now Frisbii, is a German-based subscription billing platform for streamlining recurring billing and boosting subscriber retention. It supports flexible pricing models and automates workflows for recurring payments.

This is one of the Maxio alternatives that makes it easier to manage trials, upgrades, downgrades, pauses, and renewals throughout the entire subscriber lifecycle. Its real-time analytics and dashboards offer deep insight into key metrics like churn rate, revenue growth, and subscriber lifetime value.

Key Features:

- Intelligent revenue recovery system

- Real-time analytics and reporting dashboards

- Global currency and language support

- Multi-gateway payment integration with failover capabilities

- Automated invoicing and tax compliance tools

- Personalized subscriber communication campaigns

- Custom reporting and entitlement management

- Enterprise-grade billing and account hierarchy features

Pricing:

- Starter: €49 ($57.01)/month

- Growth: €299 ($347.85)/month

- Enterprise: Custom pricing

- Media: Custom pricing

Image via Billwerk+

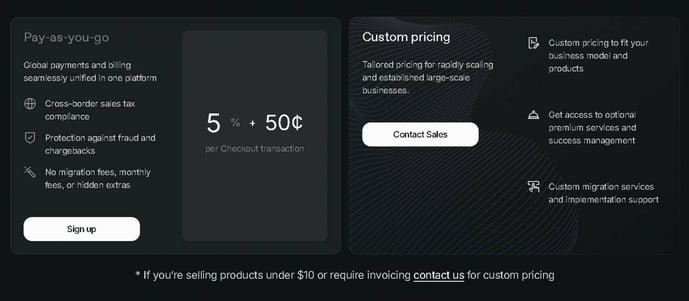

5. Paddle

Image via Paddle

Paddle is a SaaS billing platform for businesses selling digital products. Since it serves as a full Merchant of Record (MoR), it takes care of billing, tax compliance, payment processing, and fraud prevention.

Paddle integrates subscription management, payment gateways, and revenue reporting into a single platform. This way, you don’t need to use multiple tools.

With its built-in checkout localization, Paddle optimizes conversion rates for international customers. Businesses can benefit from streamlined invoicing, B2B billing, and fraud protection without having to manage these systems in-house.

Key Features:

- Global tax compliance and remittance

- Localized, high-performance checkout system

- Built-in payment fraud protection

- Automated failed payment recovery

- Free subscription analytics with ProfitWell Metrics

- Recurring and automated B2B invoicing

- Multi-product subscription flexibility

- In-app purchase infrastructure with lower fees

Pricing:

- Pay-As-You-Go Model: 5% + $0.50 per checkout transaction

For rapidly scaling or enterprise-level businesses, custom pricing is available.

Image via Paddle

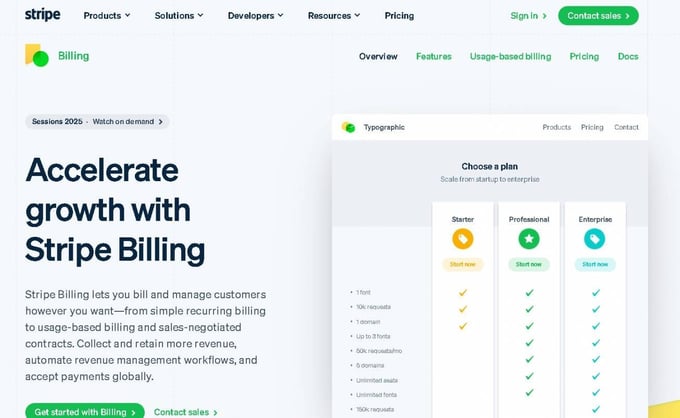

6. Stripe Billing

Image via Stripe

Stripe is one of the Maxio alternatives that support over 40 local payment methods. One of the main features of Stripe Billing is that it can adapt to various business models. Companies offering SaaS products, digital services, or physical goods with subscription plans will find this versatility useful.

The platform supports global payments, so businesses can charge customers across multiple countries and currencies. This reduces the complexity that often comes with cross-border transactions.

Businesses can also leverage built-in tools to manage compliance with regional tax regulations. This ensures smooth and lawful operations in diverse markets without using third-party tax software.

Key Features:

- Automated invoicing and recurring payments

- Smart payment recovery and dunning tools

- Global payments with multi-currency support

- Integrated tax calculation and compliance

- Real-time revenue reporting and analytics

- Customizable invoices and hosted payment pages

- Seamless integration with the Stripe ecosystem

- Supports multiple payment methods (cards, wallets, ACH, and more)

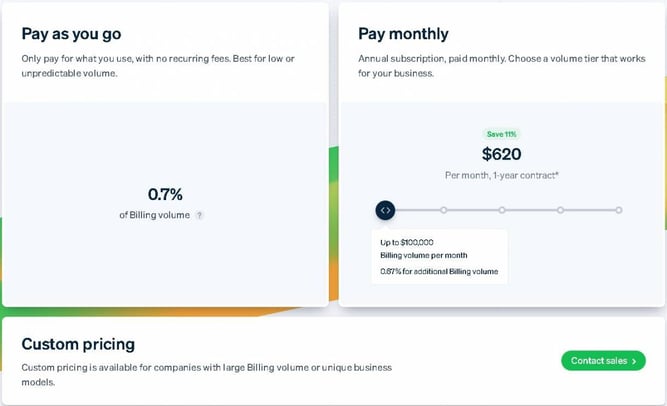

Pricing:

Stripe offers various payment models, including:

- Pay As You Go: Users are charged only for what they use, at 0.7% of the billing volume

- Monthly Plan: $620/month, billed annually

- Custom Pricing: Tailored pricing for a large billing volume

Image via Stripe

Also Read:

- Best Zuora Alternatives and Competitors to Try

- Scaling Revenue Without Breaking Finance: How SaaS CFOs Are Rewriting the Playbook

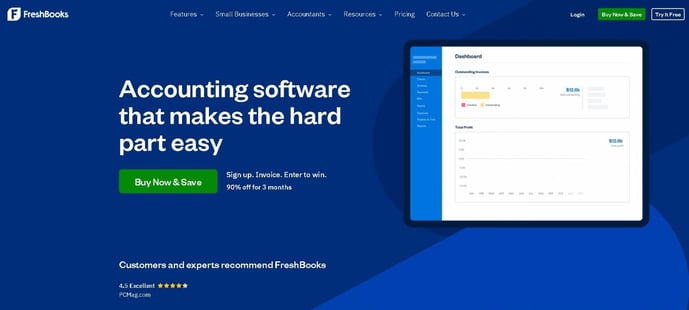

7. FreshBooks

Image via FreshBooks

FreshBooks is among the Maxio alternatives with an easy-to-use invoicing and accounting solution for small businesses. You can customize invoices with logos, payment terms, and personalized notes for customers.

Beyond invoices, FreshBooks simplifies bookkeeping, expense tracking, and project management in one platform. Another key functionality of FreshBooks that’s often not seen in other Maxio alternatives is how it supports cash flow management.

The subscription billing platform lets businesses request deposits, send recurring invoices, and set up retainers with clients. Businesses can also track time and add billable hours or expenses directly to invoices.

Key Features:

- Customizable professional invoicing

- Automated payment reminders and late fees

- Deposit requests and retainers management

- Time and expense tracking integration

- Recurring invoicing automation

- Dedicated mobile app for iOS and Android

- Client transparency and SaaS financial reporting tools

- Secure cloud-based data storage and accessibility

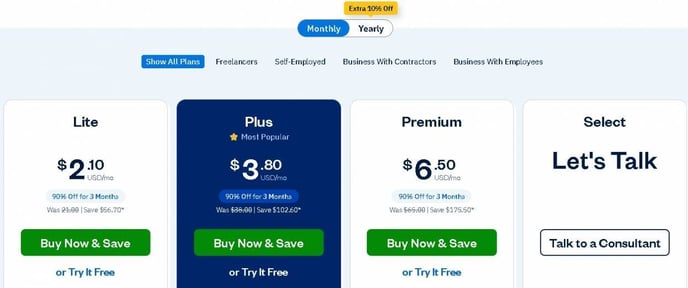

Pricing:

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Custom Plan

Image via FreshBooks

8. Xero

Image via Xero

Xero is a cloud-based accounting platform that helps you manage finances, track expenses, and streamline cash flow. You can easily send invoices, reconcile bank transactions, and process payroll.

Compared to other Maxio alternatives, Xero’s accounting features are adaptable across different industries and business types. Businesses operating in different industries can benefit from tools that allow them to create quotes, manage projects, and issue invoices based on their field.

Plus, with Xero’s ecosystem of more than 1,000 app integrations, you can connect with CRMs, ecommerce platforms, and payment gateways.

Key Features:

- Automated bank feeds and reconciliation

- Integrated payroll and compliance tools

- Expense tracking with mobile app support

- Multi-currency support for global businesses

- Professional invoicing with recurring billing support

- Inventory management for retailers and wholesalers

- App marketplace with over 1,000 integrations

- Collaborative tools for accountants and bookkeepers

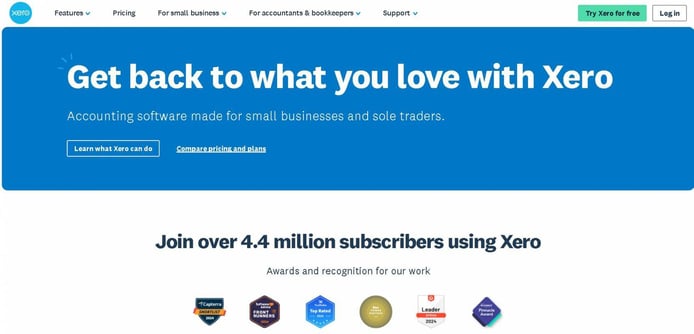

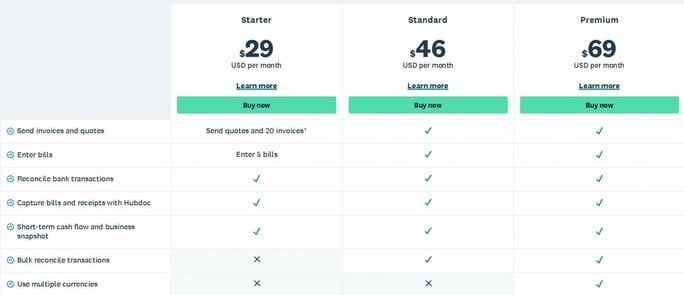

Pricing

- Starter: $29/month

- Standard: $46/month

- Premium: $69/month

Image via Xero

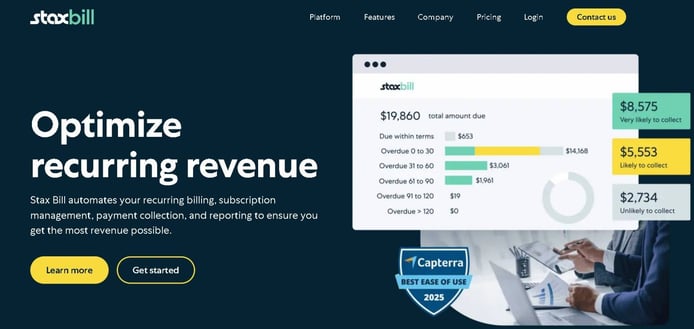

9. Stax Bill

Image via Stax Bill

For businesses looking for Maxio alternatives that can cater to complex billing needs, Stax Bill is a good option. This subscription management and recurring billing platform has built-in automation features that allow businesses to streamline billing cycles, manage account hierarchies, and handle financial reporting.

Stax Bill also helps eliminate revenue leakage by handling proration, dunning, and expired payment updates automatically. Similar to other Maxio alternatives, Stax Bill allows a variety of billing models.

Businesses can also take advantage of integrated tax calculations and multi-gateway payment options, which give them more control over global transactions.

Key Features:

- Dynamic product catalog with flexible pricing models

- Custom-hosted registration pages

- Account hierarchy for unified invoicing

- Automated proration for mid-cycle adjustments

- Lifecycle communication and renewal automation

- Dunning automation with account updater

- ASC 606-compliant revenue recognition

- Over 50 types of real-time analytics and financial reports

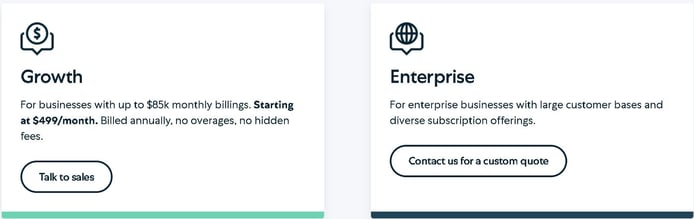

Pricing:

- Growth: $499/month for up to $85K monthly billings

- Enterprise: Custom pricing

Image via Stax Bill

Also Read:

- What Is SaaS Analytics and Which Metrics Should You Track?

- How B2B SaaS Finance Teams Can Use Technology to Their Advantage

10. QuickBooks

Image via QuickBooks

Compared to Maxio alternatives that offer specific accounting features, QuickBooks is an all-in-one solution for automated SaaS inventory, invoicing, and tax management.

With its invoicing templates, you can create custom, professional invoices, sales receipts, and estimates with detailed breakdowns. Customers can also pay online, which helps improve cash flow and minimizes delays.

Unlike other Maxio alternatives, QuickBooks includes expense tracking and tax organization. You can easily photograph and save receipts using the mobile app, which makes it easier to prepare for tax season.

Key Features:

- Expense tracking and receipt organization

- Automated bank feeds and reconciliation

- Tax categorization and sales tax tracking

- Real-time inventory management

- Mobile app for on-the-go business management

- Multi-currency support for global transactions

- Advanced financial reporting with sales forecasting features

- Professional invoicing with custom templates

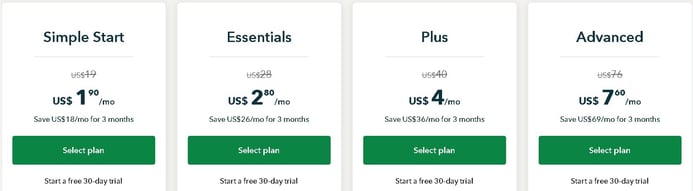

Pricing:

- Simple Start: $19/month

- Essentials: $28/month

- Plus: $40/month

- Advanced: $76/month

Image via QuickBooks

11. JustOn

Image via JustOn

Another option among Maxio alternatives for financial automation and SaaS analytics is JustOn. With this tool, businesses can manage recurring billing, one-time charges, or complex subscription models with ease.

In addition to billing and payments, JustOn includes tools for accounts receivable management. Businesses can track overdue invoices, send reminders, and manage credit information through SCHUFA integrations.

Because JustOn is built on Salesforce, it integrates easily with other Salesforce apps and tools, unlike most Maxio alternatives. Whether an organization operates in a single country or across multiple regions with various currencies, JustOn supports its financial workflows.

Key Features:

- Comprehensive billing automation processes for subscription-based and usage-based models

- Flexible invoice management solutions for high-volume, multi-currency, and multi-language operations

- Advanced recurring billing support with customizable pricing structures and contract terms

- Fully compliant e-invoicing capabilities with XRechnung and Factur-X standards integration

- Intelligent automatic payment reconciliation across multiple banking and payment provider channels

- Streamlined accounts receivable management with automated dunning and credit checks

- Integration with DATEV and external accounting systems

- Multibanking and SEP direct debit functionalities for automated payment collection

Pricing:

JustOn offers custom pricing. You can contact its sales team for a quote.

Also Read:

- Churn Analysis: Definition, Ways to Do it, & How to Monitor it

- How to Cut Tedious Tasks and Seize a Strategic Finance Seat

FAQ

1. What is Younium good for?

Younium is designed for B2B SaaS companies managing complex subscription models. It automates invoicing, tracks usage, customizes billing cycles, and ensures revenue recognition compliance with IFRS 15 and ASC 606.

The platform integrates with CRM and ERP systems to centralize subscription data and supports multi-entity operations, including multiple currencies, tax rules, and contract structures. Younium also enables hybrid growth, allowing companies to combine product-led (self-service) and sales-led models in one system. Its built-in paywall and self-service capabilities let customers upgrade, manage, or expand subscriptions directly—while finance and sales maintain full control and visibility.

2. Why look for Maxio alternatives?

Companies look for Maxio alternatives when they need features, integrations, or pricing models that better fit their business. Some may want more flexibility in billing structures, additional automation, or tools that align with their existing financial systems. Also, customer support plays a role in looking for Maxio alternatives and options.

3. Which Maxio alternative is best for large SaaS companies?

Large SaaS companies often consider Maxio alternatives like Younium, Zuora, or Sage Intacct because they support multi-entity operations, global compliance requirements, and high transaction volumes. The best option depends on factors like integration needs and internal workflows.

4. Can I migrate from Maxio to another billing platform easily?

Switching to any of the worthy Maxio alternatives is possible, but would require careful planning. The process typically involves mapping current subscription data, removing outdated or duplicate records, and configuring equivalent billing rules in the new system.

Many businesses run both systems in parallel for a short period to ensure everything works properly before fully switching.

5. Are Maxio alternatives more affordable?

Pricing varies by platform and usage. Some Maxio alternatives offer lower starting prices or flexible, usage-based billing that suits smaller or growing SaaS businesses. Others may cost the same or more but provide additional features, integrations, or support that justify the price.

Also Read:

- Transparent and flexible subscription pricing: Putting your customer first, always

- Revenue Growth Management: What It Is and Why It’s Important

Final Thoughts

Choose from these Maxio alternatives based on your business size, billing complexity, and integration needs. Younium is often suited for B2B SaaS and tech businesses with complex subscription structures and needs for a modern, flexible platform.

When researching Maxio alternatives, it’s important to evaluate the long-term value each tool can bring and not only a brand name. You’ll also want to consider customer support, ease of implementation, and how well each solution adapts and fits into your current tech stack. This ensures that your billing system can support your business as it evolves.