During the zero-interest rate COVID era, capital was free. 2020 and 2021 brought record investments in venture capital priced at record high valuations in the tech industry. In fact, going from 2020 to 2021, the number of unicorns tripled in which over $71 Billion dollars of capital was deployed according to Pitchbook data. However, today tells a different story:

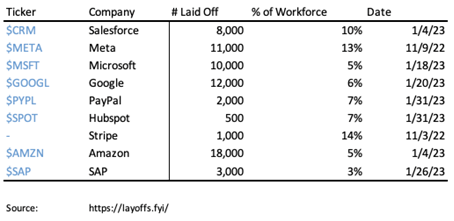

Those golden days are over. As shown above, the most recent omen to arise amongst crashing SaaS valuation multiples and hiking interest rates is a massive wave of tech layoffs. Barely 3 months into 2023 has already racked up 153,598 tech employee lay-offs which is over half of the TOTAL employees laid off in tech last year in 2022.

Although it may be easy for some to point a finger at the economic slowdown and perfect storm of macroeconomic conditions as a reason for decreasing headcount, in actuality unemployment is lower than ever at 3.6%. So, rather than macroeconomic headwinds, we should be looking for industry-specific changes. Ultimately, this event boils down to 1) Changes in investor behavior and goals which results in 2) Changes in tech company’s behaviors and goals, for both public and private companies.

The New Capital Environment

The most obvious place to start is the change in macroeconomic conditions, specifically ones that shaped the SaaS industry as of late. It is no surprise that at the outset of the COVID pandemic, significant portions of the tech industry found themselves swept up in an unprecedented wave of demand from e-commerce to SaaS. Combined with a zero-interest environment cultivated by the Fed, cost discipline was next to nonexistent and valuations sky-rocketed due to projections utilizing lower discount rates.

In respect to company behavior, the common knowledge at the time was that the road to a unicorn revolves around one thing: growth at all costs. And honestly, it worked for quite awhile— VC and PE firms alike enjoyed the soaring revenue multiples that let them sell at enormous margins.

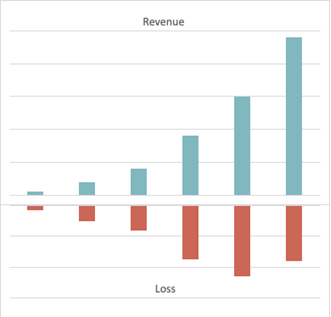

But what are the costs? In one respect, it’s quite literal: while SaaS start-ups are particularly attractive because of their rapid revenue growth, this is usually accompanied by a corresponding increase in operational costs. In other words, a majority of SaaS Start-Ups look like this in the “beginning”:

In the hopes of eventually finding a path to profitability where the topline outpaces the costs, like this:

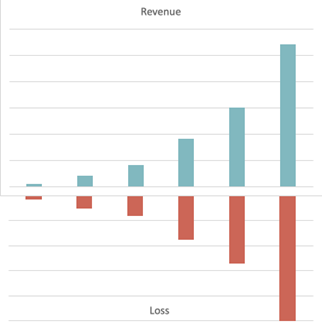

History and the waves of tech-layoffs tell us that this ideal lifecycle is rarely achieved. Why? Because investors know that despite the impressive-looking revenue numbers that your company can showcase, all revenue is not equal. Driving and sustaining quality cash flows for software companies requires different strategies for different environments. While rate expectations are low, capital consumptive companies perform well, but it certainly is not a sustainable characteristic. While tech companies usually have little trouble maintaining a high margin product, meaningful cash flows require more than that, not limited to SaaS metrics like: high retention, increasing Lifetime Value (LTV), and Share of Wallet (the percentage of your customer’s total spending). These factors matter doubly more as the cost of capital increases. Thus, in reality, most start-up tech companies that sought to take advantage of that pandemic boom still look like this:

Since cash flows at scale are empirically not sustainable, investors are looking into proof of a solid operating leverage sooner rather than later—not the cash you have on the balance sheet. In other words, C-suite executives need to start proving that increased marginal costs drive greater marginal returns rather than simply absolute returns. In a way, it is a return to focusing on profitability and efficiency. This sentiment is shared by several firms, with companies like Meta cutting back significantly on spending for the Metaverse, declaring 2023 to be “The Year of Efficiency.” Microsoft places emphasis on costs as well, demonstrating an intent to “align our cost structure with our revenue and where we see customer demand.” Most relevant for companies that are in the growth stage, the CEO of Stripe remarks on two primary reasons for their layoffs that every tech company empathizes with:

1. Being “much too optimistic about the internet economy’s near-term growth in 2022 and 2023” that resulted in them “underestimat[ing] both the likelihood and impact of a broader slowdown.

2. This optimism resulted in growing operating costs too quickly, allowing “coordination costs to grow and operational inefficiencies to seep in.”

This means venture capital firms and other investors want proof that if they are going to fund your company’s growth, there better be evidence of cash flow soon in that growth. This explains why even startups with hundreds of millions on their balance sheet are following suit by aggressively cutting costs however they can.

Now is not the time to dump capital for the sake of generating low-quality revenue. It is not just about taking on positive NPV or ROI projects—companies need to prove both profitability and efficiency. Especially for growing companies, it is the best time to front-load your investments into efficient operations and cost-cutting projects. Revenue is difficult to predict in a downturn, but you can always control your costs. During these uncertain times, you do not want to be caught three years down the line when the operational efficiencies weighing down your business are simultaneously a fundamental core of your business.

The Collapse of Tech and Regional Banks

The recent collapse of Silicon Valley Bank (SVB)—the 2nd largest bank failure in U.S. history— and subsequent bank runs of numerous regional banks merits its own discussion, but there are specific intersections with this topic of profitability, efficiency, and investor behavior. In particular, changes in VC funding behavior.

While most tech companies are already well underway with handling the present fallout with the help of the government backstopping deposits, the long-term problem is the further contraction of VC funding in an already strained environment. There are two major difficulties with this:

1. Early-stage companies that secured superb funding rounds a few years ago now faced the challenge of extending the lifespan of their capital, i.e. cash runway, beyond their scenario analysis

2. Consequently, executives need to spend an inordinate amount of time fund-raising during strained market conditions rather than their operations

According to data from CBInsights, Venture Funding is already down 27% from 2022 due to lower valuations from increasing interest rates and recession fears. SVB used to be the leading provider of Venture Debt which actually contributed to its collapse as well given that this debt was presumed to be paid-off easily if the borrowing company received another round of funding—which has been steadily decreasing. Far from the growth-at-all-costs model, tech start-ups will be hammered with increased scrutiny concerning unit economics, business fundamentals, and a path to profitability backed by concrete data. Taken together, it is more important than ever for start-ups to have polished back-ends and a single source of truth for data, not just to demonstrate to investors but to have a solid handle on your own finances.

The Pivot to Subscription-Based Revenue

To meet this demand for efficiency, several SaaS companies have opted for a subscription-based pricing model as has been the trend in the recent decades to the benefit of all parties whether investor, customer, or your own company.

The Investor’s Perspective

Investor’s like recurring revenue as it helps with projections and building predictable capital. Subscription revenue is sticky revenue, which means that customers are more likely to stay with a company for a longer time, providing a more stable cash flow.

The Company’s Perspective

From a company’s view, the Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio is greatly reduced when compared to simply selling one-off contracts with customers. A subscription model allows companies to extract greater value out of their sales teams as they do not have to constantly chase new leads since the customer is already locked in for a certain period.

The Customer’s Perspective

As a customer, many appreciate the flexibility and convenience that come with subscriptions. Cloud-based models can be continuously improved with new features and bug fixes unlike older on-premise models. This model can also lead to more frequent purchases and upgrades, which increases the lifetime value of each customer.

However, despite the potential benefits of a subscription-based pricing model, its successful implementation is not a given. Managing a B2B subscription-based company can be a logistical nightmare through revenue leakage such as missed upsells, lost renewals, missed invoices, and other inefficiencies. This is especially the case when your company’s subscription pricing grows more complex in order to capture more of the profit by developing a value-based pricing model instead of a competitor-based or a flat-fee cost basis, as given a more complex pricing structure, revenue recognition also becomes complicated. This is due to mixed pricing of up-front annual contracts combined with custom packages that may include: usage, flat, and recurring fees which are all subject to change based on the customer's needs over the contract term.

This revenue leakage can quickly undermine the advantages of your pricing strategy. However, it is worth noting that revenue leakage is entirely within the company's control, as the customer has already agreed to the pricing set by the company. Thus, addressing revenue leakage should be a top priority as doing so can result in the recovery of high-quality revenue that would have otherwise been lost.

What Makes a Company Efficient?

Business theory distinguishes between two types of cost: variable costs (VC), which vary directly with sales volume (e.g. direct labor), and fixed costs (FC), which vary with time rather than sales volume (e.g. salaries). In downturns, companies with a high operating leverage (FC/VC) in which fixed costs dominate the cost base perform poorly because they still have to pay that fixed cost regardless of how well business is. The higher the operating leverage, the more sensitive the Income Statement is to changes in volume.

During COVID, many growth businesses invested heavily in fixed costs to accommodate volumes as a bet on rapidly growing demand. When it did not manifest, their cash reserves evaporated and VC term sheets dried up. To decrease operating leverage, businesses should invest in operational solutions that can scale with their company, balancing the avoidance of stranded costs with the avoidance of becoming heavily reliant on outdated, legacy solutions. In an environment of high inflation and investor concern for efficiency and profitability over growth, B2B subscription-based companies can benefit from implementing a subscription management solution to improve cost structure and operating efficiencies. The best solution must have both these qualities, being scalable in both its cost and capability to avoid the dual issues of a high operating leverage and building your core operations on a system not built to grow.

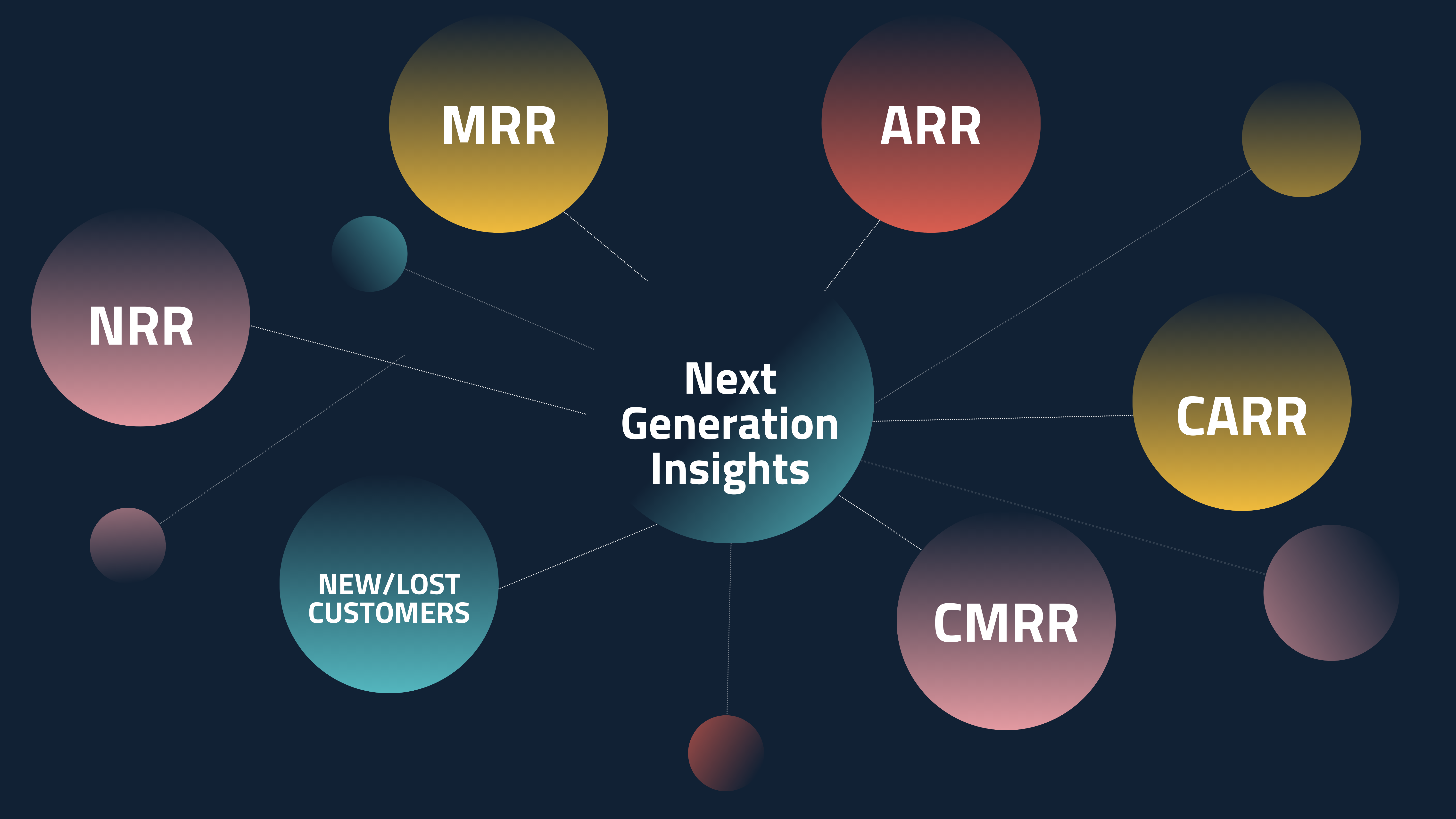

In an age of increased scrutiny, it is a considerable value-add if these solutions are designed to provide clear metrics and KPIs to demonstrate how your subscription business is performing. The key is to invest in projects that promote the stability of your company’s finances. For better or worse, the tech world must finally abandon the mantra of growth-at-all-costs and double down on the business fundamentals.