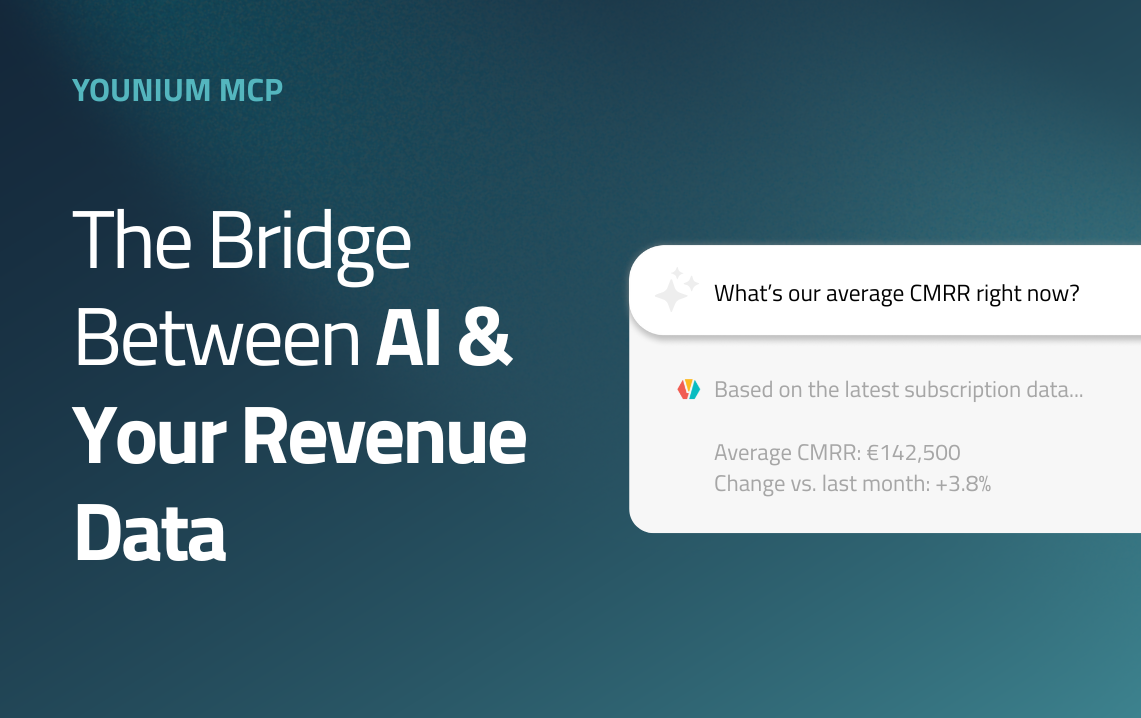

MCP: The Bridge Between AI and Your Revenue Data

What if AI could truly understand your revenue? Explore how Younium MCP makes that possible with secure, context-rich connections to your financial data.

What if AI could know your revenue? What if the days of digging through spreadsheets and dashboards were over?

Imagine asking your AI assistant about your revenue data as easily as you ask what time zone it is in another country.

With Younium MCP, that vision becomes reality.

AI in Finance: The Promise and the Plateau

AI has become a powerful tool for finance teams, helping them work faster, automate manual tasks, and uncover insights at scale. But after the initial excitement, many organizations find that progress slows.

Traditional AI tools can summarize information and surface trends, but they often stop short of creating real operational value.

To make a lasting impact, AI for finance needs more than public info and data. It needs context. It must understand your systems, your customers, and your financial logic.

That is where the Model Context Protocol (MCP) comes in, bridging the gap between AI-generated insights and real, context-aware insights.

What is MCP (Model Context Protocol)?

If you have followed the latest AI developments, you have probably seen a new concept: the Model Context Protocol (MCP).

In simple terms, MCP is a bridge that allows AI systems to safely and reliably access real business data and functionality without requiring direct database access or complex custom integrations. By using an MCP server, you get the benefits of AI-powered insights and automation while maintaining full control over what data can be accessed, how it's used, and maintaining comprehensive audit trails of all interactions.

How Younium MCP Works

The Younium MCP server specifically acts as a secure gateway between AI assistants and your Younium billing and subscription data, enabling these systems to retrieve customer information, financial metrics, subscription details, and invoice data on demand. MCP servers follow strict protocols for authentication, data privacy, and method validation, ensuring that only authorized requests are processed and sensitive information is protected.

For finance teams, this means less digging, faster insights from live financial data, and a smarter, more connected finance stack.

Currently, the Younium MCP serves as a secure access layer rather than a two-way API. Connected AI tools can extract and analyze data but cannot yet modify or create new records such as customer entities. Future development will however expand these capabilities.

Finance Intelligence, Not AI Fiction

This marks the first step toward a new era of financial operations powered by agentic AI, where data does more than inform decisions, it drives them.

This is not about replacing finance professionals with machines. It is about giving teams the intelligence and automation they need to work smarter, faster, and with greater foresight.

The long-term vision is simple:

“AI that not only explains your business but helps run it.”

Want to learn more about how Younium MCP turns financial data into real-time insight and action? Head over to the MCP page to get all the details!